The Benefits Of Compounding Through SIPs

What took a year a decade ago now takes just a month. Systematic Investment Plans have gone from INR 44,000 cr/year in 2016-17 to INR 1,56,000 cr in 2022-231. Compounding with SIPs has become the way to go!

While compounding is a remarkable wealth-building force, Systematic Investment Plans (SIPs) are the ideal vehicle for benefitting from compounding's potential. As of September 2023, there were approximately 7.13 cr SIP accounts actively contributing to Indian Mutual Fund schemes as compared to 1 cr account in April 20162. This shows that Indian investors have embraced SIPs. In this blog, we will explore how compounding and SIPs work together to be the magical wand in growing your money steadily and safely. Let us start!

Understanding Compounding

Compounding is the process of earning interest or returns on your initial investment and gaining more interest on the interest you have already earned. Let us break it down with an example for better understanding.

Imagine you invest INR 1,00,000 at an annual interest rate of 10%. In the first year, you will make INR 10,000 in interest. This brings your total to INR 1,10,000. Now, here is where compounding comes in. In the second year, you will earn 10% interest not just on your initial INR 1,00,000 but also on the INR 10,000 you earned in the first year as interest. So, you will make INR 11,000, not just INR 10,000.

| Year | Invested Amount (INR) | Return (INR, Non-Compounded) | Return (INR, Compounded) |

|---|---|---|---|

| Year 1 | 100,000 | 1,10,000 | 1,10,000 |

| Year 2 | - | 1,20,000 | 1,21,000 |

| Year 3 | - | 1,30,000 | 1,33,100 |

This process continues. After a few years, you will notice exponential investment growth over time. This is what compounding is.

Understanding SIPs

A Systematic Investment Plan is a straightforward and disciplined approach to investing in any financial instrument like mutual funds, bonds, and even stocks. Instead of putting a big part of your money into an investment all at a time, you decide to put in a fixed amount at regular intervals. This regularity can be monthly or quarterly, whatever suits your financial rhythm and inflows.

SIPs thrive on consistency. So, this disciplined approach can change your investment game for good. They come with the following benefits that can make a big difference in your financial planning:

- Affordability

You do not need a massive lump sum to start investing. You can begin with a small amount. It could be as low as a few hundred rupees. This affordability makes investing available to a broader range of people. - Convenience

You can set up your SIP to automatically deduct at a chosen period. You do not need to time the market about when to invest. It is a "set it and forget it" approach that aligns with your financial goals seamlessly. The discipline to invest regularly is quite important, and automatic SIP deduction brings that to your financial journey. - Lower Risk

Investing can be intimidating. This holds true, especially when markets are volatile. SIPs help reduce this fear. When you invest a fixed amount regularly, you can buy more units when prices are low and fewer units when prices are high. This strategy is known as rupee-cost averaging. Over time, it helps lower your average purchase price and makes market ups and downs smoother. - Ideal For Long-term Wealth Creation

Consistently investing over the years can make you benefit from the power of compounding. Your money earns returns, and those returns further earn returns. This creates a snowball effect that can grow your wealth significantly. - Flexibility

You can increase or decrease your investment amount according to your financial goals. For instance, you can improve your SIP with a salary hike or a bonus. Similarly, you can reduce it if you expect a tight budget in the coming months. Moreover, you can also pause or even stop your SIPs.

The Combination Of Compounding And SIPs

In the initial stages of your SIPs, your wealth might not increase much. But, an SIP is not a sprint but a marathon. Consistently adding to your investments or re-investing your returns can magnify the compounding effect. Moreover, time is one of your most potent allies in investing. The longer your money compounds, the greater the potential for exponential growth.

An Example To Understand The Magic Of Compounding

Let us understand the magic of compounding with the help of an example.

Assumptions:

- Interest Rate - 9%

- Retirement Age - 65

- Compounding - Annually

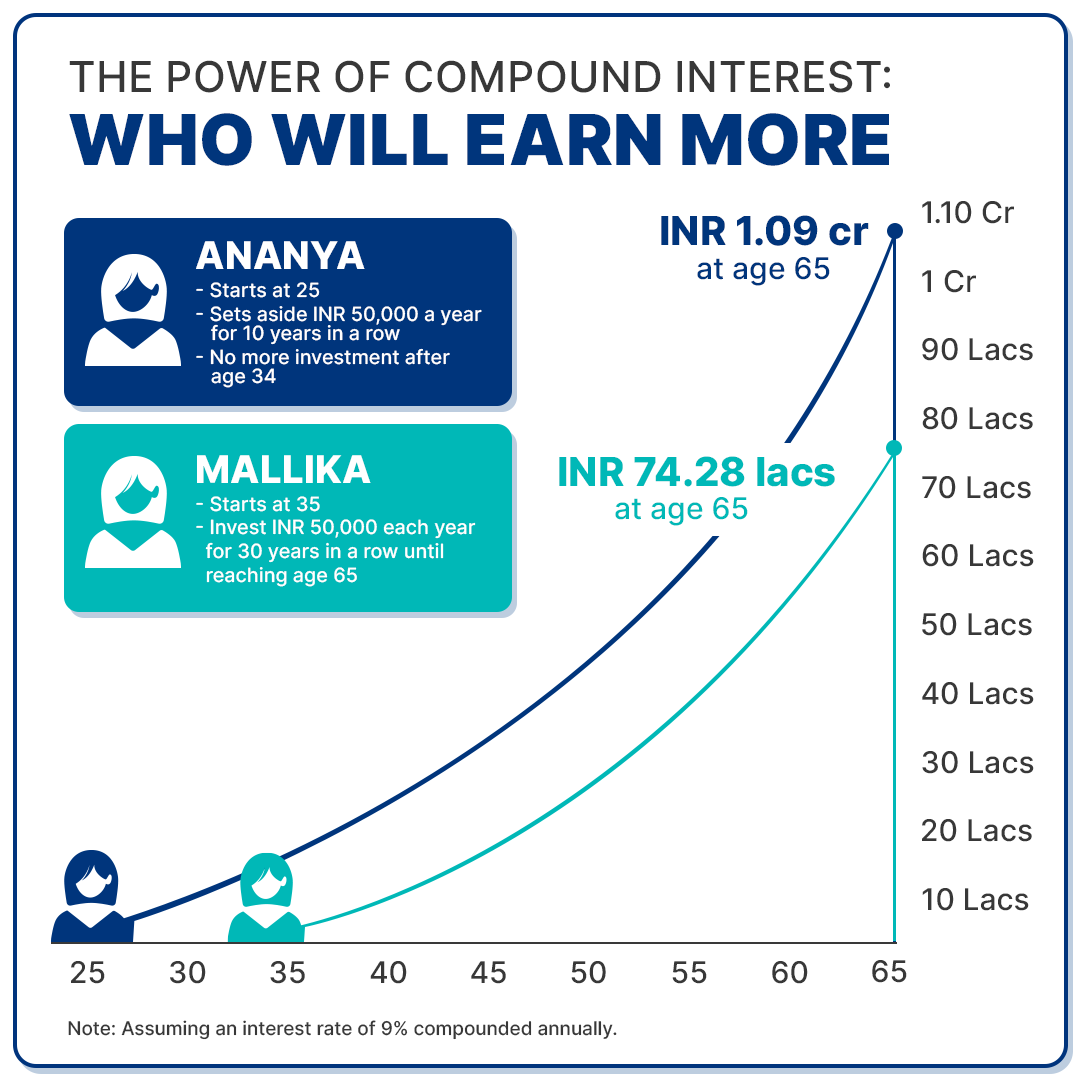

- Ananya, a young banker, started investing at the age of 25 and keeps on investing INR 50,000 every year for ten consecutive years. After age 34, no additional investments are made, and the money is left to grow until she retires at 65.

- Mallika, a manager working for a corporation, started investing INR 50,000 when she turned 35 and invested for 30 consecutive years until retiring at age 65.

Who will have more money at 65 – Ananya or Mallika?

Ananya, who started investing at 25 years old and made ten total payments of INR 50,000, will end up with approximately INR 1.09 cr at age 65. Mallika, the 35-year-old who made 30 total payments of INR 50,000, will end up with approximately INR 74.28 lacs at age 65.

Leveraging Compounding With SIPs: Tips And Strategies

SIPs and compounding align well with changing investment trends and economic scenarios. In addition to starting early and leveraging rupee cost averaging, here is how you can benefit from SIPs and compounding:

- Regularly review your financial objectives, risk tolerance, and investment horizon. If required, adjust your SIP portfolio to align with your evolving goals and scenarios.

- According to your risk appetite and economic outlook during economic downturns, you may lean more toward debt or conservative investments. As the economic scenario improves, you can shift to higher-risk, higher-reward options.

- Set up an emergency fund through a separate SIP to cover unforeseen expenses. This way, you do not have to liquidate your primary SIP investments during economic crises prematurely.

- Save on your taxes using SIPs. For example, ELSS (Equity-Linked Savings Scheme) offers tax benefits under Section 80C of the Income Tax Act.

So, when you embrace SIPs effectively and allow your money to compound, you can watch your investments grow exponentially, helping you to achieve your financial goals.

Conclusion

Compounding is essentially earning on earnings. SIPs make this process easy with affordability, convenience, and risk reduction through rupee-cost averaging. Leveraging compounding with SIPs involves intelligent strategies such as early starts and diversification.

Consider starting your journey to financial prosperity with SIPs and see your wealth multiply. Earlier, SIP was limited to mutual funds. However, Grip Invest brings systematic investment to non-market linked assets like corporate bonds. Learn how SIP works for corporate bonds and stay updated with the latest financial trends.

References:

- Association of Mutual Funds in India <https://tinyurl.com/bevru4jk>

- Association of Mutual Funds in India <https://tinyurl.com/muvjj6f5>

Want to stay at the top of your finances?

Join the community of 2.5 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading.

This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for consequences of any actions taken based on the information provided. For more details, please visit www.gripinvest.in

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001