Navigating Fixed-Income Investments: Bond Funds Vs. Bond ETFs

Introduction

Fixed-income investing has always been an essential part of a well-diversified portfolio. As an investor, it's crucial to understand various investment options to optimise your returns and manage risk effectively. This guide will provide a comprehensive overview of bond funds and bond ETFs, two popular fixed-income investment choices, to help you make informed decisions. Let's dive in!

Bond Funds: An Overview

Bond funds are investment vehicles that pool investor money to purchase a diversified portfolio of bonds, such as government, corporate, and municipal bonds. Managed by professional portfolio managers, bond funds offer investors an easy way to gain exposure to fixed-income securities without purchasing individual bonds. Recent AMFI data reveals that the Indian Mutual Fund Industry's AUM reached INR 39.42 trillion on March 31, 2023, doubling from INR 21.36 trillion in just five years1.

How Does A Bond Fund Work?

A bond fund operates as a mutual fund focusing solely on investing in bonds. For many investors, bond funds present a more efficient method for bond investments compared to purchasing individual bond securities.

Distinct from individual bonds, bond funds lack a specific maturity date for principal repayment, causing the principal amount invested to fluctuate periodically.

Moreover, as an investor in a bond fund, you receive a share of the interest generated by the underlying bonds within the mutual fund's portfolio. The fund makes interest distributions regularly, reflecting the composition of its holdings. Consequently, the distribution of interest income undergoes frequent changes.

Why Should You Invest In Bond Funds?

Here are some reasons why you should consider investing in bond funds as part of your overall investment strategy:

- Diversification: Bond funds invest in different types of bonds. This spreads your investment across many bonds, reducing risk.

- Managed by experts: Professionals manage bond funds. They watch the market and make smart choices for you, which can lead to better returns and lower risks.

- Regular income: Bond funds usually pay interest often. This gives you a steady income and a dependable source of money from your investments.

- Balanced portfolio: Adding bond funds to your investments helps create a balanced mix. This makes your portfolio stronger and more stable.

- Lower risk: Bond funds can reduce risks found in other income-generating investments.

- Meeting financial goals: By considering your money goals and how much risk you can handle, you can make good choices for a robust and diverse portfolio that fits your needs.

Bond ETFs: An Overview

Bond ETFs, or Exchange-Traded Funds, are investment funds that track a specific bond index and trade on an exchange like a stock. Bond ETFs offer exposure to various bonds, including government, corporate, and other fixed-income securities, through a single investment.

How Do Bond ETFs Work?

Bond ETFs function as passively managed funds that are traded on stock exchanges, similar to how stock ETFs operate. This approach enhances market stability by improving liquidity and transparency, particularly during challenging times. Although bond ETFs are known for their volatility, they need to maintain liquidity to be traded on exchange platforms.

Why Should You Invest In Bond ETFs?

Investing in bond ETFs can offer several benefits for investors looking to diversify their portfolios and manage risk. Here's why you should consider adding bond ETFs to your investment strategy:

- Easy to trade: Bond ETFs are traded on stock exchanges like stocks. This makes buying and selling them simple and convenient.

- Lower costs: Bond ETFs are passively managed, typically resulting in lower fees than actively managed bond funds.

- Transparency: With bond ETFs, you can easily see the fund's holdings and performance, making it easier to understand what you're investing in.

- Liquidity: Bond ETFs are known for their liquidity, meaning you can quickly buy or sell them when needed.

- Diversification: Investing in bond ETFs helps diversify your portfolio by providing exposure to various fixed-income securities, reducing risk.

In short, bond ETFs can be a valuable addition to your investment portfolio, offering a combination of liquidity, transparency, and diversification while keeping costs low.

Discover a World of Exciting Investment Opportunities – Join Grip Now!

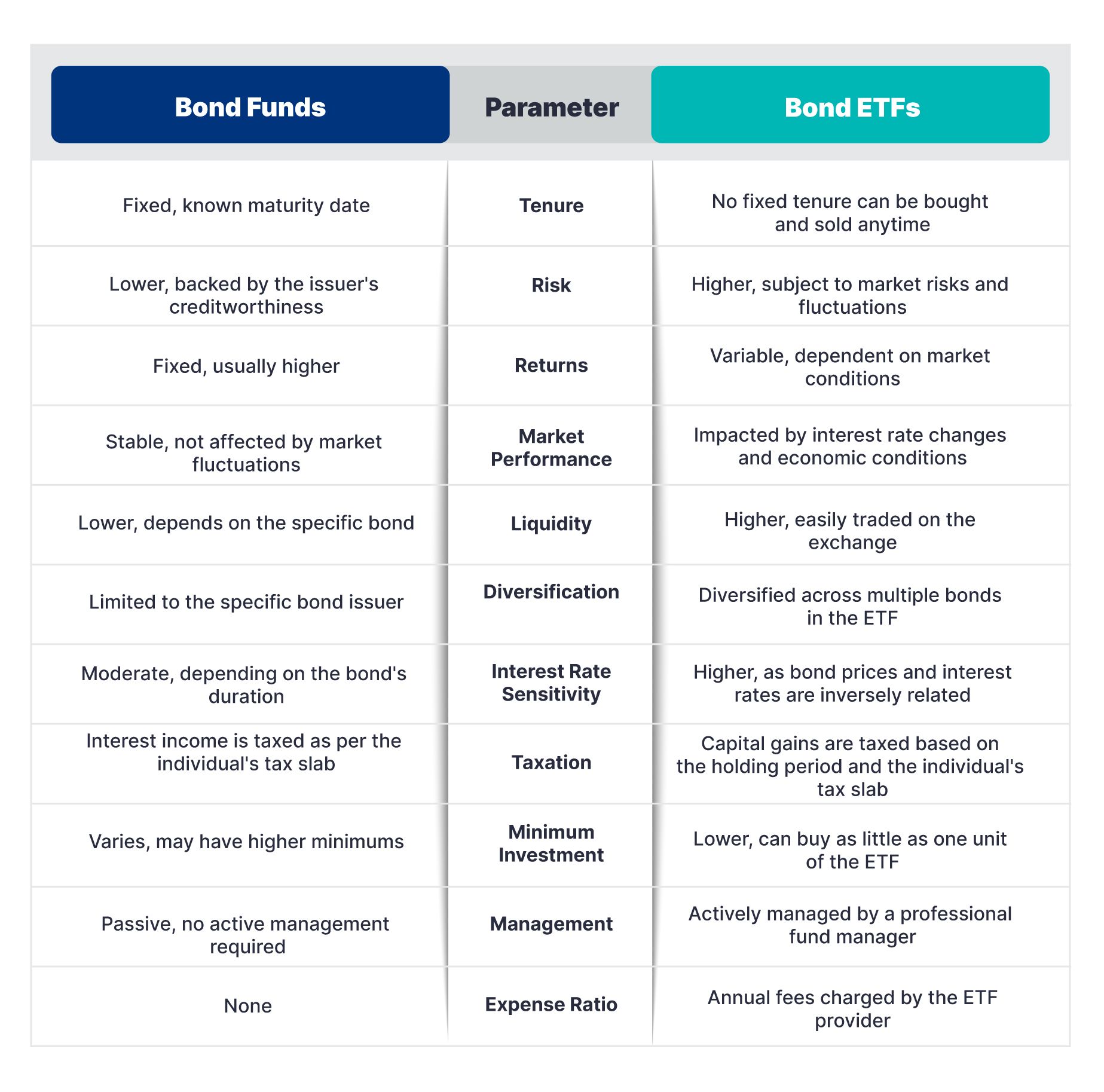

Comparing Bond Funds and Bond ETFs

Factors to Consider When Choosing Between Bond Funds and Bond ETFs

- Investment goals and risk tolerance: Consider your financial objectives, time horizon, and risk appetite before choosing between bond funds and bond ETFs.

- Professional management: Bond funds may be better if you prefer active management and professional expertise.

- Diversification: Bond and ETFs offer diversification, but the degree may vary depending on the specific fund or ETF.

- Preference for active vs passive management: Bond funds typically involve active management, while bond ETFs follow a passive approach by tracking an underlying index.

Conclusion

Bond funds and bond ETFs both offer attractive fixed-income investment options with unique features and benefits. By understanding the key differences between them and evaluating your investment objectives, you can make an informed choice that best suits your financial goals. So, take charge of your investment journey and make the right decision for your portfolio.

References:

1. Association of Mutual Funds in India <https://www.amfiindia.com/indian-mutual#:~:text=Assets%20Under%20Management%20(AUM)%20of,at%20%E2%82%B9%2039%2C42%2C031%20crore>

Want to stay at the top of your finances? Don’t forget to sign up!

Join the community of 2.5 lakh + investors and learn more about Grip, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer: This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip Invest Technologies Private Limited ("Grip") is not registered with SEBI in any capacity and does not advise, encourage, or discourage its users to invest or not invest in any securities. Grip is solely an execution-only platform and does not guarantee or assure any return on investments made by you in any opportunities sourced by Grip and accepts no liability for consequences of any actions taken based on the information provided. Your investment is solely based on your judgement. Investments in debt securities are subject to risks. Read all the offer related documents carefully.