Muthoot Capital: Powering India’s Mobility Dreams Through Trusted Two-Wheeler Financing

Introduction To Muthoot Capital Services Limited

Muthoot Capital Services Ltd. (MCSL), established in 1994, is a trusted name in India’s automobile finance space. It is part of the renowned Muthoot Pappachan Group and operates as a systemically important, deposit-taking Non-Banking Financial Company (NBFC) registered with the Reserve Bank of India (RBI). The company is listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), reflecting its credibility and transparent governance. Initially offering gold loans, MCSL shifted its focus to two-wheeler financing in 1998 and has since become one of the leading players in this segment. As of March 31, 2024, the company had an Assets Under Management (AUM) of INR 2,018 crore, with two-wheeler loans making up about 88% of its portfolio.

Muthoot Capital Services offers both fund-based and non-fund-based financial services to a wide range of customers, including retail, corporate, and institutional clients. The company provides Two-Wheeler Loans, Used Car Loans, and investment options like Fixed Deposits. It operates through the extensive branch network of Muthoot FinCorp Ltd., reaching customers across India, especially in semi-urban and rural areas. With a mission to empower individuals and support aspirations, MCSL combines easy access to credit with financial guidance, helping people fulfil their dreams, especially when it comes to owning a vehicle or building their financial future.

Source: Muthoot Capital1

Board Of Directors Of Muthoot Capital

As of April 2025, the Board of Directors of Muthoot Capital Services Ltd. comprises the following members:

Executive Director:

- Tina Suzanne George – Executive Director

Non-Executive Directors:

- Ritu Elizabeth George – Non-Executive Director

- Susan John – Non-Executive Director

Independent Directors:

- Mrs. Shirley Thomas – Independent Woman Director

- Thomas Mathew – Independent Director

- CA. Divya Abhishek – Independent Director

Source: Muthoot Capital1

Products Offered By Muthoot Capital

Muthoot Capital Services Limited offers a diverse range of financial products tailored to meet the needs of individuals and businesses. Here is a detailed overview of the products they provide:

1. Two-Wheeler Loans

Muthoot Capital provides financing solutions for purchasing two-wheelers, offering up to 100% funding. This enables customers to own their desired bikes or scooters without financial strain. The loans come with competitive interest rates and flexible repayment options, making it easier for individuals to manage their finances while achieving mobility.

2. Used Car Loans

For those looking to purchase pre-owned vehicles, Muthoot Capital offers used car loans with affordable interest rates and manageable instalments. These loans are designed to help customers acquire reliable used cars, ensuring flexibility in repayment and quick processing times.

3. Fixed Deposits

Muthoot Capital's fixed deposit schemes are ideal for individuals seeking secure investment options. With interest rates reaching up to 9.05% per annum, these deposits cater to various financial goals. The company offers multiple schemes:

- Scheme A: Non-cumulative deposits with monthly interest payouts.

- Scheme B: Non-cumulative deposits with annual interest payouts.

- Scheme C: Cumulative deposits where interest is compounded and paid at maturity.

Each scheme requires a minimum deposit of INR 1,000 and offers tenures ranging from 1 to 5 years. Additional features include loan facilities against deposits and joint account options.

4. Secured Business Loans

Entrepreneurs and business owners can benefit from Muthoot Capital's secured business loans, which provide the necessary capital to start or expand their ventures. These loans are backed by collateral, ensuring lower interest rates and higher loan amounts, thereby supporting business growth and development.

5. Subordinated Debts

To strengthen its financial base and support long-term business activities, Muthoot Capital offers subordinated debts through private placements. These instruments are suitable for investors seeking fixed-income opportunities and contribute to the company's resource augmentation.

6. Loyalty Loans

Recognising the value of long-term customer relationships, Muthoot Capital provides loyalty loans to existing customers with a good repayment history. These pre-approved loans offer quick access to funds, catering to immediate financial needs without the hassle of extensive documentation.

Muthoot Capital Services Limited's comprehensive product portfolio is designed to cater to various financial requirements, ensuring customer satisfaction and financial inclusion.

Muthoot Capital Customer Care

For any queries or support, Muthoot Capital’s customer care team is here to help. You can reach them at 1800 102 1616 (toll-free) or email mail@muthootcap.com. You can also connect with them on WhatsApp at 7994990002.

Also Read: Manba Finance: Revolutionising Two-Wheeler Loans with Technology and Trust

Innovation And Technology At Muthoot Capital

Muthoot Capital Services Limited (MCSL) is committed to leveraging technology to enhance customer experience and streamline financial services. The company offers a range of digital solutions to make loan applications and repayments more accessible and convenient for its customers.

1. Digital Loan Application And Repayment Platforms

MCSL provides an online platform where customers can apply for loans, such as two-wheeler and used car loans, with minimal paperwork. The application process is designed to be user-friendly, allowing for quick approvals and disbursals. Additionally, the company offers digital repayment options through its mPower App, enabling customers to manage their loan repayments efficiently.

2. Focus On Electric Vehicle Financing

Recognising the growing demand for electric vehicles (EVs), MCSL has tailored its financing solutions to support the purchase of EVs. The company provides loans for electric two-wheelers and cars, facilitating the adoption of sustainable transportation options among its customers.

Through these technological initiatives, Muthoot Capital Services Limited aims to provide seamless and efficient financial services, catering to the evolving needs of its customers.

Key Strengths Of Muthoot Capital

1. Strong Support from the Muthoot Pappachan Group (MPG)

Muthoot Capital Services Ltd. (MCSL) is a key part of the Muthoot Pappachan Group (MPG), whose main company is Muthoot FinCorp Ltd. (MFL). MCSL benefits greatly from being part of this large and well-known group. The promoters and directors of MCSL are the same as those in other companies of MPG, which creates strong connections and collaboration within the group. Mr. Thomas John Muthoot, the chairman of MCSL, also holds leadership roles in other MPG companies. MCSL uses the branch network of the group, especially that of MFL, to find new customers and manage loan collections. It also shares its sales and operational resources with other group companies. As part of the MPG family, MCSL can rely on regular operational, managerial, and financial support whenever needed.

2. Adequate Capitalisation

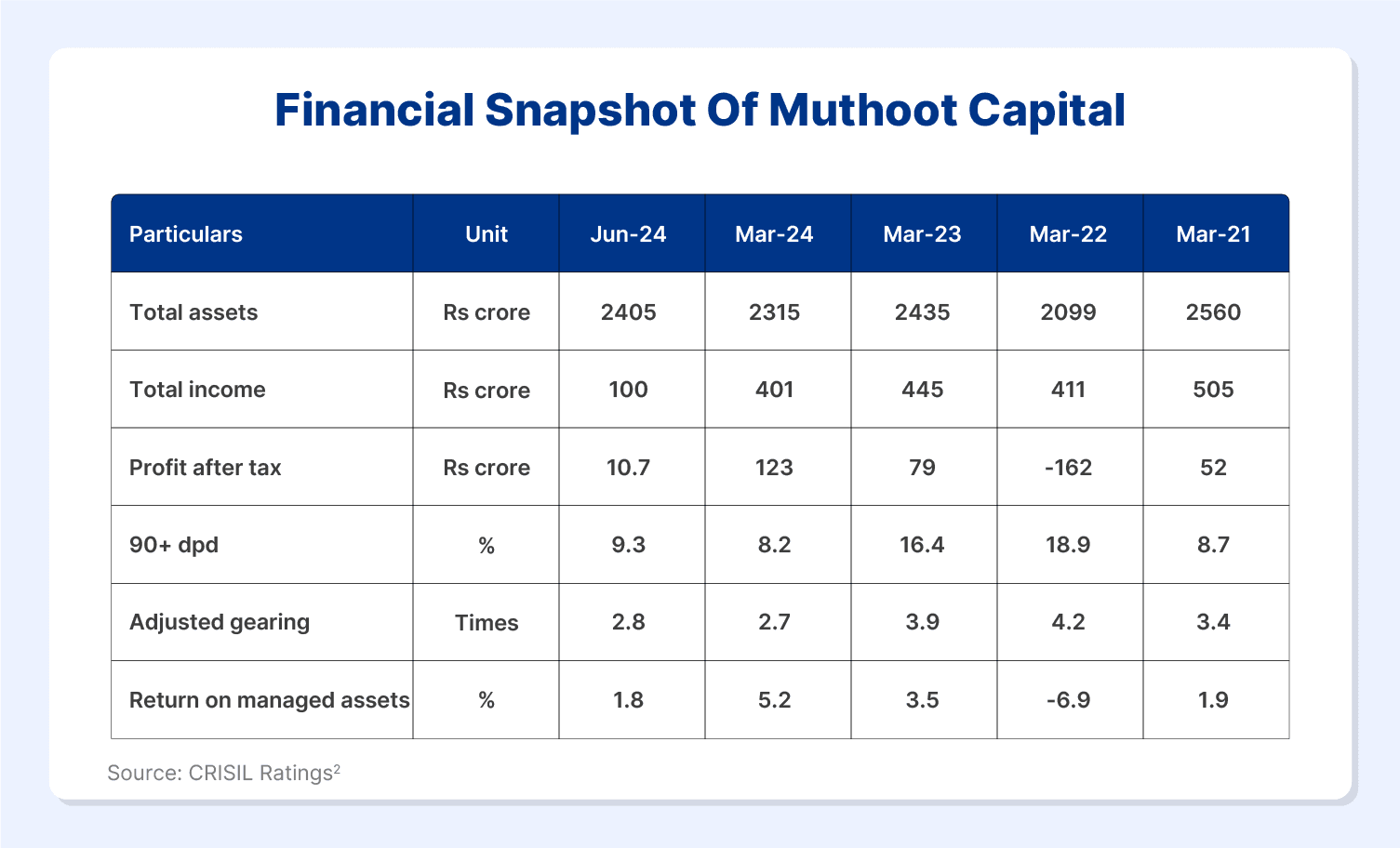

MCSL's capital strength has improved in FY 2024, mainly due to profits earned over time. As of June 30, 2024, the company’s net worth stood at INR 622.9 crore and its debt-to-equity ratio was 2.8x. This is a positive change from March 31, 2023, when the net worth was INR 489 crore and the gearing was higher at 3.9x. Even though the company hasn't received major capital infusions in the last five years, its financial health has stayed strong. MCSL aims to maintain its debt-to-equity ratio at around 5x under normal conditions, indicating a balanced approach to borrowing and capital growth.

3. Experienced Promoters and Skilled Management Team

MCSL is led by a team of promoter-directors who have more than 30 years of experience in the lending business. They started with gold loans and later expanded into two-wheeler loans, microfinance, housing finance, and more. Since entering the two-wheeler loan market in 1998, the company has added used car loans, small business loans, and consumer durable financing to its portfolio. The company has further strengthened its leadership by appointing experienced professionals like Mr. Mathews Markose (CEO), who has 26 years of banking experience, Mr. Ramandeep Singh Gill (CFO), a chartered accountant with over 11 years of experience, and Ms. Umadevi (Chief Risk Officer). These leaders have helped improve the company’s systems and processes, which support its plan to grow while keeping loan quality strong. With a strong brand reputation, especially in South India, the group continues to refine its loan evaluation methods for better customer service and risk control.

Source: CRISIL Ratings2

Financial Snapshot Of Muthoot Capital

To arrange the capital, Muthoot Capital Services Limited also offers Corporate Bonds. These opportunities from the company are secured and are rated by credit rating agencies. On Grip Invest, investors invested in a CRISIL ‘A+’ rated Corporate Bond opportunity of the company that offered fixed returns of up to 10.7%. To invest in similar, rated, regulated, and secured fixed-income opportunities, sign up for Grip Invest today and start earning fixed returns:

References

- Muthoot Capital, accessed from: https://www.muthootcap.com/board-of-directors/

- CRISIL Ratings, accessed from: https://tinyurl.com/CRISIL-Muthoot

Want to stay at the top of your finances?

Join the community of 4 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks, and shenanigans in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading.

This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for consequences of any actions taken based on the information provided. For more details, please visit www.gripinvest.in

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001