How Economic Factors Influence Stock And Corporate Bond Prices?

Stocks and Corporate Bonds rank among the most popular traditional investment options. Various economic factors drive these two assets' performance and value in the financial markets. For making wise investment decisions, it is essential to comprehend these critical economic indicators and their effects on these conventional assets.

In this blog post, we will examine how the economy and financial markets are related, look at the factors that specifically affect stocks and corporate bonds, consider the effects of the global economy, and understand the value of economic analysis when making investment decisions.

Relationship Between Economic Indicators And Financial Markets

The financial markets and the overall economy are closely related. Economic indicators like Growth Domestic Product (GDP) growth, inflation, unemployment, consumer spending, and industrial production act as crucial guideposts, offering perceptions of the general state of a nation's economy.

The performance of corporate bonds and equities frequently reflects the trends of these indicators. Stocks often benefit from strong economic growth and stability, while economic downturns may cause value decreases. Similarly, any monetary policy change by the Reserve Bank of India (RBI) with a change in interest rates will impact the bond market value.

The development of business and industry, which substantially impacts the general health of the country's economy, is significantly influenced by the stock market, a vital economic pillar.

Investors and traders routinely examine the economic data to comprehend stock market prices and their future tendencies. Some people also monitor the market indices to understand how the economy is doing.

The stock market and economy typically move hand in hand. If the GDP rises and the economy strengthens, stock market values will likely reflect the momentum over a longer horizon. However, news events and policy reports that might not impact a country's macroeconomic fundamentals often cause the financial markets to react excessively (on either side).

Economic Factors Affecting Stock Prices

Here are the key economic factors that affect Stock prices summarised in an infographic, followed by their descriptions:

- GDP Growth: A healthy economy with resilient GDP growth numbers boosts business earnings and investor confidence, raising the indices and stock values.

- Interest Rates: Changes in interest rates have an impact on the cost of borrowing money and consumer spending, which has an impact on stock market performance. While rising rates may cause investors to switch to other assets like debt instruments and fixed deposits, lower rates favour stocks.

- Consumer Spending: Strong consumer spending boosts stock prices, especially in industries like FMCG, automobile, travel and hospitality, etc., that cater to consumers.

- Corporate Earnings: The performance of a stock is greatly influenced by company-specific factors, such as earnings releases. Positive earnings reports often increase stock prices, but adverse earnings reports might result in drops.

- RBI’s Policies: Monetary policies implemented by RBI significantly impact the stock market. An accommodative stand with reduced interest rates, injecting liquidity into the financial system, can boost investor confidence and increase stock prices. On the other hand, tightening monetary policies to curb inflation may have the opposite effect.

Economic Factors Affecting Corporate Bond Prices

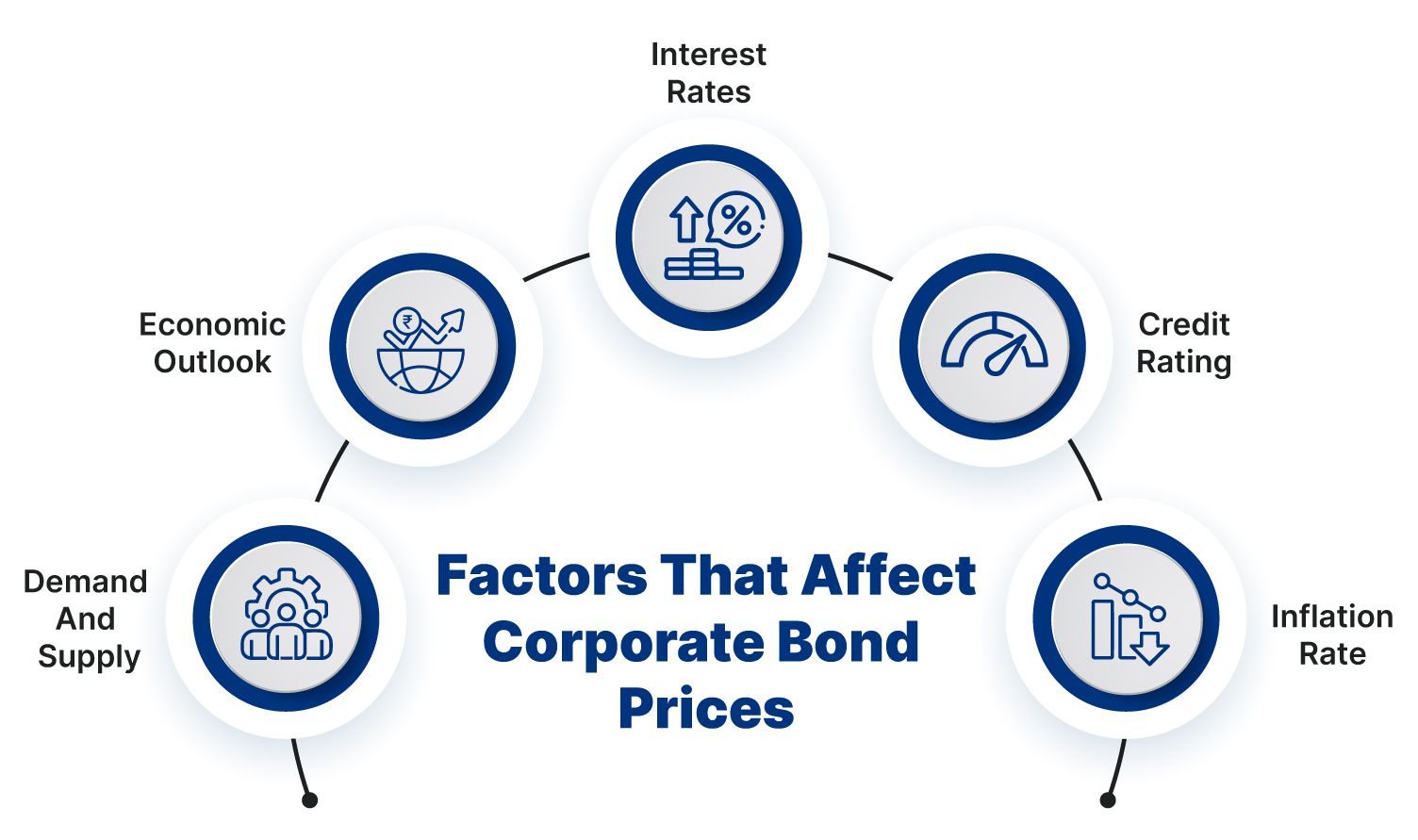

Here are the key economic factors that affect Corporate Bond prices summarised in an infographic, followed by their descriptions:

- Interest Rates: Corporate bond costs are inversely related to interest RBI’s monetary policies determining rates. Bond prices go down when the rates are increased, and vice versa.

- Credit Rating: Bond prices are influenced by the issuing company's creditworthiness. Bonds with higher ratings typically have lower yields but are considered safer investments.

- Inflation Rate: The purchasing power of fixed-income assets like bonds is diminished by inflation. Investors require high yield bonds when inflation rises to compensate for the long-term value decline.

- Economic Outlook: The overall state of the economy impacts how risky corporate bonds are. Bond prices may rise during uncertain times due to investors favouring safer bonds.

- Demand And Supply: The bond yield changes based on the bond's current price in the secondary market, which is influenced by demand and supply dynamics. For instance, if the bond's current market price is higher than its face value, the yield will be lower than the coupon rate.

Impact Of Global Economic Factors On Asset Prices

Global economic factors also significantly affect equities and corporate bond pricing. Let us discuss them as follows:

- Trade Relations: Trade conflicts between powerful economies can stifle corporate profits and disrupt supply networks, affecting equities and corporate bonds. For e.g., the conflict between Russia and Ukraine resulted in a shortage of gas and semiconductors, affecting the supply chain and, thus, the demand side of concerned industries.

- Commodity Prices: Changes in commodity prices can affect profitability by contracting industries' margins and stock performance for the industries dependent on these commodities.

- Global Interest Rates: Changes in the global interest rate can impact local interest rates, which can impact corporate bond yields and funds flow in the equity market.

Importance Of Economic Analysis In Investment Decision-making

- Risk Management: Economic analysis aids in the identification of potential hazards that may be attached to an investment. Understanding how economic conditions affect assets makes it easier to do better risk management.

- Investment Timing: Economic indicators offer insightful information about the market cycle, allowing investors to time their entry and exit in stocks and bonds strategically.

- Asset Allocation: Researching the current economic trends helps and guides the investor to decide on allocation to various asset classes.

- Diversification: Understanding the effect of economic factors on the performance of various assets allows for diversification and better risk-reward management.

Conclusion

Economic factors significantly impact the performance of equities and corporate bonds. Evaluating the influence of economic factors on stocks and corporate bonds requires a deep understanding of the country’s economic landscape. When making investment choices, investors must pay close attention to various factors like GDP numbers, interest rates, company earnings, credit ratings, inflation, and overall economic conditions.

Investors can better navigate the fluid financial markets with the help of economic analysis. Explore Grip Invest to stay updated on the latest economic trends and understand economic factors to help you make sound and informed investment choices.

Want to stay at the top of your finances?

Join the community of 2.5 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities are subject to risks. Read all the offer-related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading. This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip Invest”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip Invest or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip Invest does not guarantee or assure any return on investments and accepts no liability for the consequences of any actions taken based on the information provided. For more details, please visit https://www.gripinvest.in/.

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001.