Mutual Funds Vs. Asset Leasing: Examining Different Paths To Investment Success

Investment has always been a fascinating subject. It presents a chance to make money and broaden your financial horizons. However, the unpredictable market conditions and overall portfolio risk considerably threaten the possibilities of investment success.

As an investor, you would want your returns in double digits. Equities? It could be a way to higher returns, but it requires long-term investment and is prone to high market volatility. How about fixed-income options? The part with fixed income sounds convincing; however, the returns rarely cross the threshold of 8% with conventional fixed instruments. So, precisely what options do you have? Welcome to the world of alternative investments.

Alternative Investments comprise assets that are not a part of traditional investments. It includes any investment that goes above and beyond the conventional options (FDs, Stocks, Bonds, and Mutual Funds). It enables you to invest in non-conventional asset classes for portfolio diversification.

This article will explore the significance of investment and highlight two popular investments- Mutual Funds and Asset Leasing, and their features to help you make a worthwhile investment.

Importance Of Investment For Financial Growth

Investing involves purchasing assets or securities with the prime aim of generating income and capital appreciation.

Some reasons emphasising the importance of investment are:

- Wealth Creation: Investing means placing your money where it can generate more money in the future. These investments provide high returns over time to help you build wealth.

- Inflation: Inflation can significantly reduce the worth of your hard-earned money with time. A commodity costing INR 100 will cost INR 125 a few years from now. Investing your funds in a liquid instrument acts as a hedge against soaring inflation.

- Retirement: Not everyone saves money for their retirement. And even those who do may fail to last through the coming years. You need not burn your entire savings for investment. You can put away a small sum of money and frame a strategy to align your financial situation with your retirement goals.

What Are Mutual Funds?

A Mutual Fund is a company that pools money and manages it. Multiple investors come together to collect money to achieve a shared objective. The professional then invests the gathered capital in various financial assets.

A Mutual Fund is like professional management of your investments. It is a vehicle comprising bonds, stocks, or other securities overseen by a financial expert.

Characteristics Of Investing In Mutual Funds

Investing in Mutual Funds can be a sensible decision given their features:

- Professional Management: Professionals manage the funds and carefully make investment decisions based on the market and the initial objective of the fund.

- Liquidity: You can redeem your Mutual Funds units to face any financial emergency. The redemption amount is credited to your bank account within a few days, depending on the type of scheme.

- Flexible: Mutual Funds are flexible and allow you to invest in two ways. You can regularly invest small amounts or pay it in a lump sum per your preference.

Factors To Consider When Investing In Mutual Funds

Everything is not shiny and bright all the time. You must keep certain factors in mind before you invest in Mutual Funds:

- Investment Goals: Are you seeking growth or value? Understand your investment goal to determine and invest in the suitable Mutual Funds category.

- Net Asset Value (NAV): NAV means the market value per unit of a Mutual Fund. It is calculated as Net Assets / Total Units. Usually, the unit cost of Mutual Funds starts at INR 10 and increases as the assets under the fund increase in value.

- Exit Load: Some Mutual Funds have an exit load you must pay in case of premature exit. Hence, carefully assess and evaluate your needs and options before deciding on the investment option.

What Is Asset Leasing?

Leasing is a strategy where the asset's owner or lessor agrees to rent an asset. It involves the renting of movable or immovable assets for a fixed time. Asset Leasing is a contract between the lessor and the lessee.

The owner of the asset, the lessor, lends or leases it to the lessee or borrower at a particular cost for a specified duration. The lessee uses the asset and makes regular payments throughout the lease term to the lessor.

Grip offers LeaseX, a unique product that allows investors to lease different kinds of assets to different companies, all in one investment instrument. This makes it a unique investment product that combines the benefits of diversification, attractive returns, and an easy-to-understand investment structure.

Characteristics Of Investing In Asset Leasing

Asset Leasing is a viable option for investment success. Some of its features include:

- Steady Passive Income: Asset Leasing offers investments that have the potential for a steady income. You can earn quick and fixed monthly returns through lease payments.

- Asset-Backed Investment: Leasing provides investments backed by assets. It acts as a secure form of collateral and proves more reliable than other forms of investing.

- Non-Market Linked Investment: Income or revenue generated from Asset Leasing is not directly tied to the performance of financial markets such as bonds, stocks, or indices.

Factors To Consider When Investing In Asset Leasing

The investors should consider the following before investing:

- Deal Tenure: Lease contracts come with tenure. They may or may not have liquidity options facilitating early exits. Hence, ensure you know the period before investing in Asset Leasing.

- Company Financials: Conducting proper and accurate research to learn about the enterprise you are engaging with is critical. You must analyse their financial and background history and gather relevant information to ensure security and transparency.

Key Considerations For An Investor

Now you know the differences and working processes of Mutual Funds and Asset Leasing. Here comes the question: Which option will help you attain investment success?

There is no one-size-fits-all solution in investments, to be honest. However, considering some essential factors and aspects can make it more transparent for you to make informed choices.

- Return On Investment (ROI): ROI refers to the amount you gain after deducting the principal amount. It comes in the form of returns and capital appreciation. Further, knowing the number of periodic returns is equally crucial.

- Risk: Every investment accompanies a share of risk, which may affect your investment decision. You must learn about the associated risks and practice strategies to mitigate them.

- Volatility: The rise and fall in market prices can adversely influence your return rates. Investments with lower volatility imply stable and steady returns despite the market conditions. You must consider these fluctuations before investing.

- Quality Of Return Factor: The primary reason behind investing is the high return. You would want a consistent return throughout the term. Hence, considering the return quality is essential to ensure steady income before investing.

- Tax Benefits: Some investments bring tax implications, and others come with benefits. Considering tax rate, liability, and impact are other crucial deciding factors.

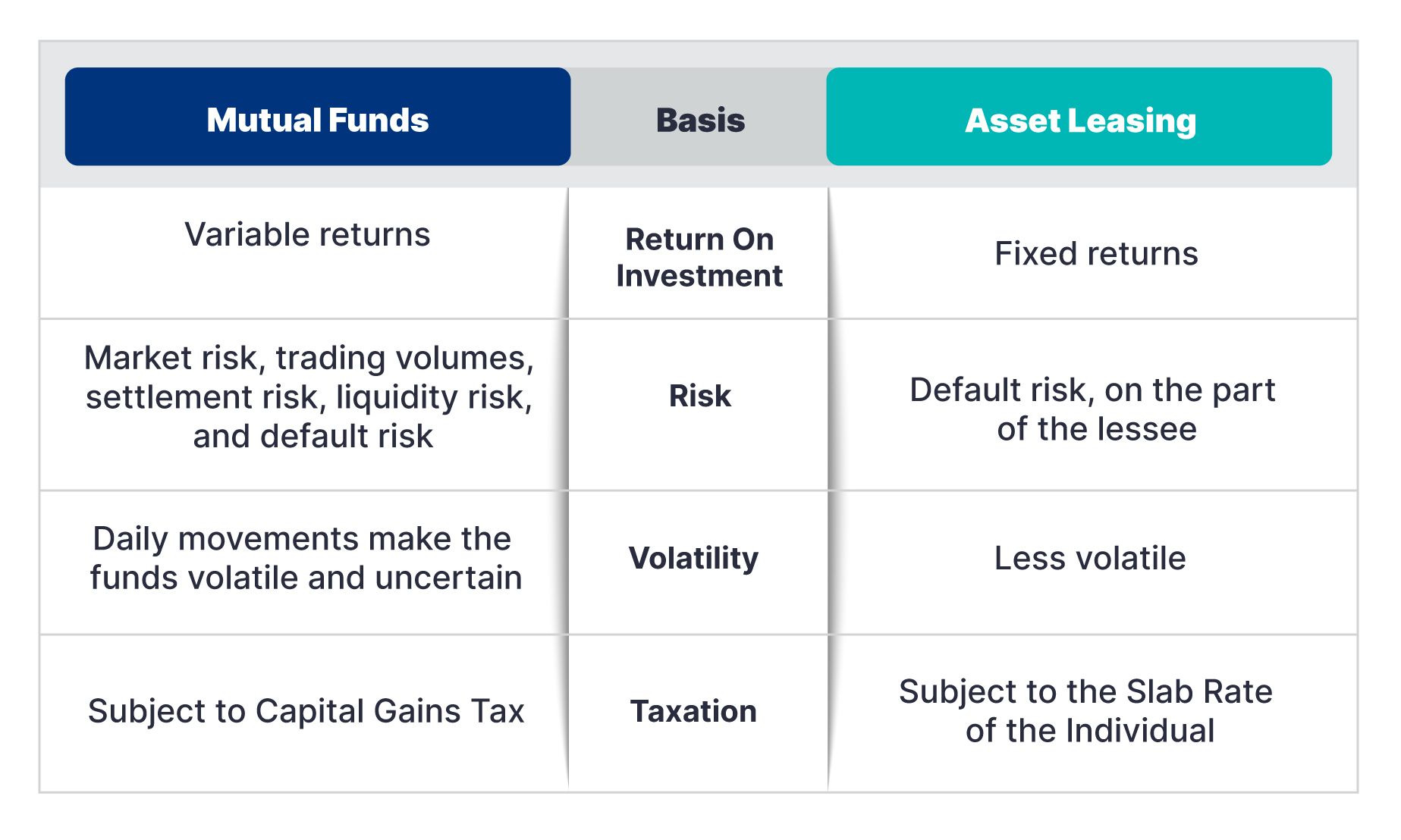

The table below compares both options on multiple criteria.

The Bottom Line

Mutual Funds and Asset Leasing have their fair share of pros and cons. Ultimately, the choice depends on your investment goals, risk appetite, and investment horizon. Mutual funds allow you to access a diversified portfolio with limited capital. Meanwhile, Asset Leasing can provide a steady income stream through lease payments. Thus, it can be an attractive investment choice for investors looking for diversification and passive income. Are you interested in trying out the lucrative approach to earning fixed returns?

Grip provides investment opportunities in rated and regulatory-compliant lease finance with fixed returns (LeaseX by Grip).

Want to stay at the top of your finances?

Join the community of 2.5 lakh+ investors and learn more about Grip, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer: Investments in debt securities are subject to risks. Read all the offer-related documents carefully. The investor is requested to consider all the risk factors before the commencement of trading. This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for the consequences of any actions taken based on the information provided. For more details, please visit https://www.gripinvest.in/.

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001.