Key Indicators Of A Potential Stock Market Crash

In one of the iconic scenes of Christopher Nolan’s Batman Trilogy, Selina Kyle (aka Catwoman) warns Bruce Wayne about an approaching storm. Unaware of the looming danger, Wayne is subtly cautioned about an inevitable upheaval.

Similarly, in the world of investing, stock market crash indicators serve as early warnings, signalling that the market may be overheated or overvalued. If you are a stock market investor, recognising these indicators can help you adjust your strategy, diversify your portfolio, and prepare for potential economic downturns before they happen. The good news is that several key signals can alert you to any potential stock market crash, allowing you to take proactive steps to safeguard your investments.

Some of the stock market red flags include economic slowdowns, excessive speculation, rising interest rates, and geopolitical uncertainty. Their impact severely affects retail investors and daily traders, especially bulls, who thrive in a rising market.

Let us discover the most critical factors you must not miss out on while investing in equities to forecast an upcoming crash effectively.

What Is A Stock Market Crash?

In financial market terminology, a stock market crash is described as a sudden and significant decline in stock prices due to persistent selling, often accompanied by negative market sentiment and panic. Stock market crashes can be caused by geopolitical, economic downturns, financial instability or any other external factors and not particularly due to company-related factors.

These crashes often result in wiping off billions in market capitalisation. Such crashes can have a massive impact on your long-term financial planning. They often underline the importance of having a diversified portfolio with some proportion allocated to fixed-income securities.

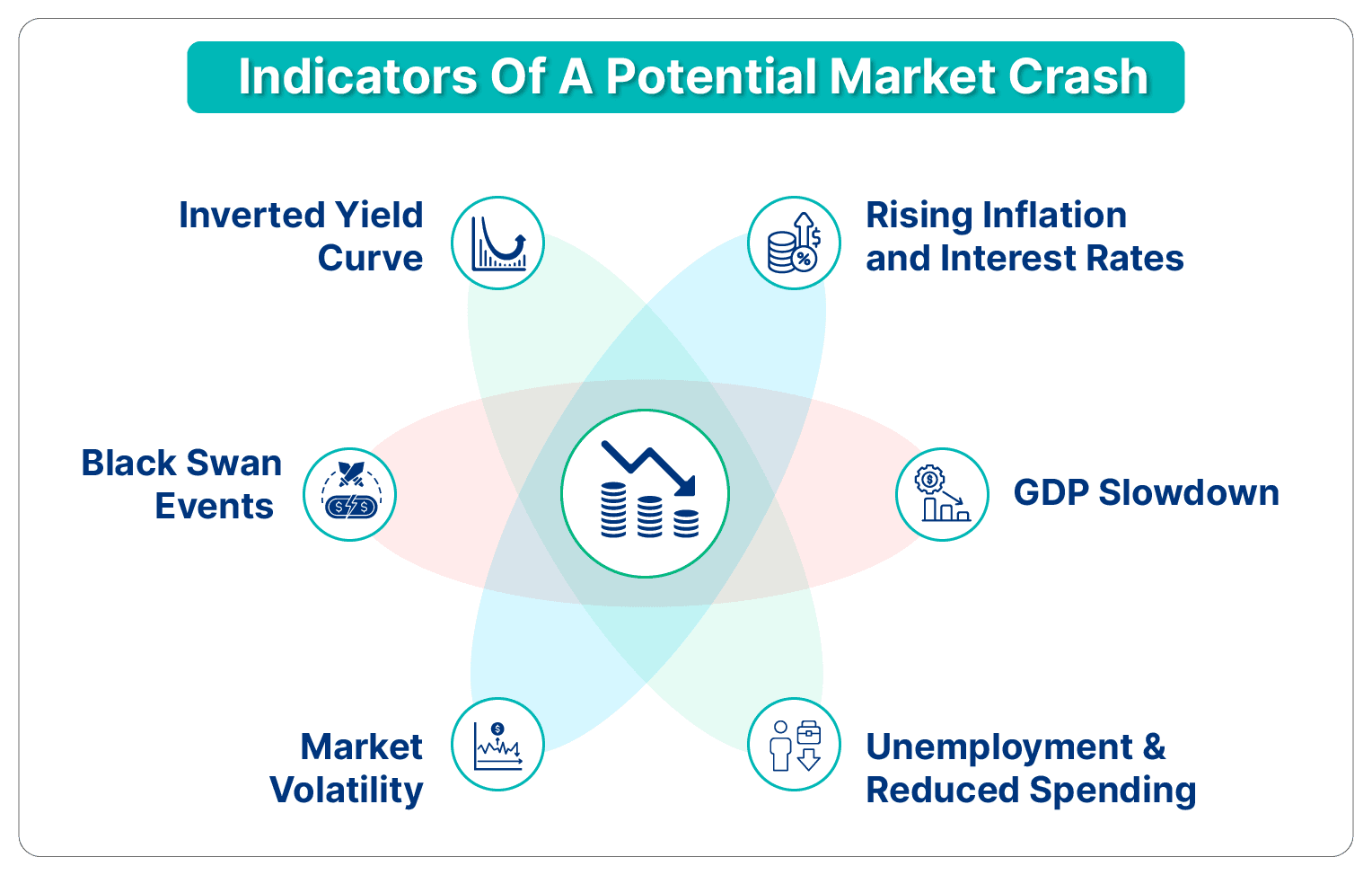

Economic Indicators Of A Stock Market Crash

Here are a few macroeconomic warning signals that might indicate a potential stock market crash:

1. Rising Inflation And Interest Rates: Inflation reduces customer purchasing power and can erode corporate profits. When the interest rates are increased, it can result in making borrowing costlier for businesses and consumers. Both factors negatively affect stock prices.

2. GDP Slowdown: As an economy thrives, the corporate sector also flourishes. On the contrary, a slowdown signals weaker business activity. Some prime indicators of a slowdown are declining industrial output, reduced exports, and sluggish private investment. All these factors eventually negatively affect the market price.

3. Unemployment And Lower Spending: Some common issues include job issues, reduced disposable income, and limited discretionary spending, which results in a decline in stock prices.

4. Increased Market Volatility: A significant rise in market volatility, measured by indices like the VIX, suggests heightened investor uncertainty1. Elevated volatility often precedes market downturns as investors react to perceived risks.

5. Black Swan Events: Unpredictable events, such as natural disasters, geopolitical tensions, or pandemics, can cause sudden market downturns. These events disrupt economic stability and investor confidence, leading to rapid declines in stock prices.

6. Inverted Yield Curve: Typically, long-term interest rates are higher than short-term rates. Contrary to that, an inverted yield curve occurs when this relationship reverses, indicating that investors expect future economic downturns. This inversion has historically preceded recessions and can lead investors to shift towards safer assets, negatively impacting stocks.

An investor needs to be aware of these indicators and take informed decisions. One should diversify his portfolio with non market linked opportunities to ensure the stability. Non market linked opportunities help the investors to maintain the overall returns of the portfolio. To explore options like corporate bonds and securitised debt instruments (SDIs), register on Grip Invest.

Corporate And Financial Risks: Warning Signs Of A Market Crash

Besides the macroeconomic factors and indicators, multiple corporate and financial sector risks often convert into a stock market crash.

Some of them are explained as follows:

1. High Corporate Debt: When large companies or corporations from key industries have taken huge debt to expand their operations, servicing the debt can be a major issue, especially when the external factors are not favourable.

There are numerous examples where companies filed for bankruptcy as their incomes were insufficient to fund debt. This leads to a stock price reduction and often affects an entire sector. Investors lose confidence, triggering widespread sell-offs.

2. Declining Corporate Earnings: When corporate earnings decline due to internal inefficiencies or external factors, businesses report lower-than-expected profits, raising concerns about the market health. This can trigger stock downgrades, creating a ripple effect that may lead to a stock market crash.

3. Banking And Financial Sector Crisis: A surge in bad loans weakens banks, restricting credit availability to businesses and consumers. For example, recently reported frauds (e.g., IL&FS crisis, Yes Bank crisis) shake investor confidence and trigger panic selling. This can result in a credit crunch, reduced trust in the financial and banking system, and an eventual stock market crash.

4. Program Trading: Program trading, which involves high-speed, algorithm-driven stock transactions, can intensify market volatility. During downturns, these automated strategies trigger mass sell-offs, accelerating losses and causing a cascading effect.

The 1987 Black Monday crash is a notable example where program trading contributed to the rapid market decline. Understanding its impact is essential in assessing modern market risks and sudden fluctuations. There are also more recent examples of significant losses due to program trading mechanisms and glitches attributed to trading software2.

Liquidity And Market Stability Signs Of A Market Crash

Here are some of the liquidity and market stability-related stock market crash indicators:

I. Panic Selling And Market Volatility: When the fear and nervousness in the market are high, many investors start selling rapidly to avoid losses, thereby pushing the entire market into a selling spree. Further, if stock market volatility signals have persisted for a long period, it is assumed that the trades are panic-driven and not on fundamentals.

Major indices, including Sensex and Nifty, have experienced huge swings, often triggering lower circuit limits and further escalating the crisis.

II. FIIs (Foreign Institutional Investors): In emerging markets like India, FIIs pour a lot of money and are some of the biggest contributors to liquidity. When FIIs are on a selling spree, the market often follows the trend. Some common reasons for institutional selling include global economic instability, US Federal Reserve rate hikes, or geopolitical tensions.

III. Credit Market Tightening: In periods of financial crisis and uncertainty, banks and financial institutions try to avoid risks, and credit conditions become more stringent. Companies and small businesses find it difficult to arrange funds, including working capital.

A credit crunch reduces economic activity, lowers corporate earnings, and triggers job cuts, further weakening investor sentiment. All these factors result in potential market crashes.

Prolonged Economic Downturn And Market Instability

The long-term consequences of a market crash can reshape financial systems and influence economic policies for years. Financial institutions often reassess risk management, increasing capital reserves and liquidity buffers to withstand future downturns. Regulators may impose stricter oversight to curb excessive risk-taking and enhance market stability.

The labour market faces lasting effects, with businesses turning to cost-saving measures like automation and outsourcing. While these market strategies improve efficiency, they can lead to job displacement, requiring workers to upskill to stay relevant.

This shift underscores the need for adaptive workforce development programs and education reforms aligned with evolving industry demands. Ultimately, market crashes drive structural changes that redefine economic and financial landscapes.

Conclusion

Stock market crashes are an inevitable part of the ever-evolving global economy. While avoiding all the impacts of a stock market crash today is nearly impossible due to the inherent risks of equity investing, staying vigilant can help mitigate losses. Monitoring key warning signs of a market crash—such as economic indicators of a market downturn, corporate financial distress, liquidity crunch, and investor panic—can provide early indications of an approaching bear market and help safeguard your investments.

As an investment measure, you must have a diversified portfolio with a mandatory inclusion of fixed-income securities such as corporate bonds. Log in to Grip Invest and get access to such investment options, providing stability to your portfolio while ensuring periodic, risk-free returns even when the equity markets fail to deliver.

Frequently Asked Questions On Stock Market Crash Indicators

1. Can you avoid a stock market crash?

While individual investors cannot prevent a stock market crash, they can protect their investments by diversifying portfolios, avoiding excessive leverage, and staying informed about economic trends. Investing in defensive sectors like healthcare, utilities, and gold can help mitigate risks during market downturns. Maintaining a long-term perspective and avoiding panic selling can also reduce losses.

2. How long do recessions last?

The duration of a recession varies, typically lasting anywhere from a few months to several years, depending on economic conditions. Historically, in India and globally, recessions have lasted 6 to 18 months, with recovery driven by government stimulus, monetary policy adjustments, and market corrections. The 2008 financial crisis, for example, led to a global recession that lasted over a year, but markets eventually rebounded.

3. Do stocks recover after a crash?

Yes, stock markets historically recover from crashes, though the timeline varies. Markets often undergo correction, consolidation, and growth phases before returning to previous highs. Investors who remain patient and continue investing in fundamentally strong stocks tend to benefit in the long run. For example, after the COVID-19 market crash in 2020, global indices, including the Sensex and Nifty, rebounded significantly within a year.

References

1. Money Control, accessed from : https://www.moneycontrol.com/news/business/markets/india-vix-the-fear-index-hits-six-month-high-as-experts-caution-over-near-term-nervousness-12915686.html

2. Henricodolfing, accessed from: https://www.henricodolfing.com/2019/06/project-failure-case-study-knight-capital.html

Want to stay at the top of your finances?

Join the community of 4 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks, and shenanigans in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading.

This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for consequences of any actions taken based on the information provided. For more details, please visit www.gripinvest.in

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001