What Is LoanX?

You may already be a shareholder in India’s listed NBFCs like Bajaj Finance, L&T Finance Holdings, Shriram Finance, and Muthoot Fincorp. or have heard about these companies and the role they play in India’s economic growth. NBFCs are RBI-regulated entities that provide loans to individuals, MSMEs, and even large corporates.

But how do NBFCs get money to provide these loans? NBFCs use three methods:

- Equity: Raising equity via an Initial Public Offering (IPO) or Qualified Institutional Placement (QIP)

- Bonds: Issuing Corporate Bonds i.e. the debt instruments precisely the ones you may have seen on Grip’s platform

- Securitisation: Selling the economic interest in loans to investors by converting them into tradable securities

As an investor you already invest in NBFCs and provide them capital via equity and bonds, so why not via Securitisation as well?

CRISIL estimates that NBFCs raised 1.8 lakh crore (1 followed by 12 zeros!) via securitisation last year. All of these investments were made by just 100 investors consisting largely of foreign, private, and public sector banks1!

Grip's vision is to ensure that individual investors can access the same investment opportunities as these large investors and build healthy, diversified portfolios. In line with that vision, we launched LoanX on 20th July 2023.

What Are The Key Features Of LoanX For Investors?

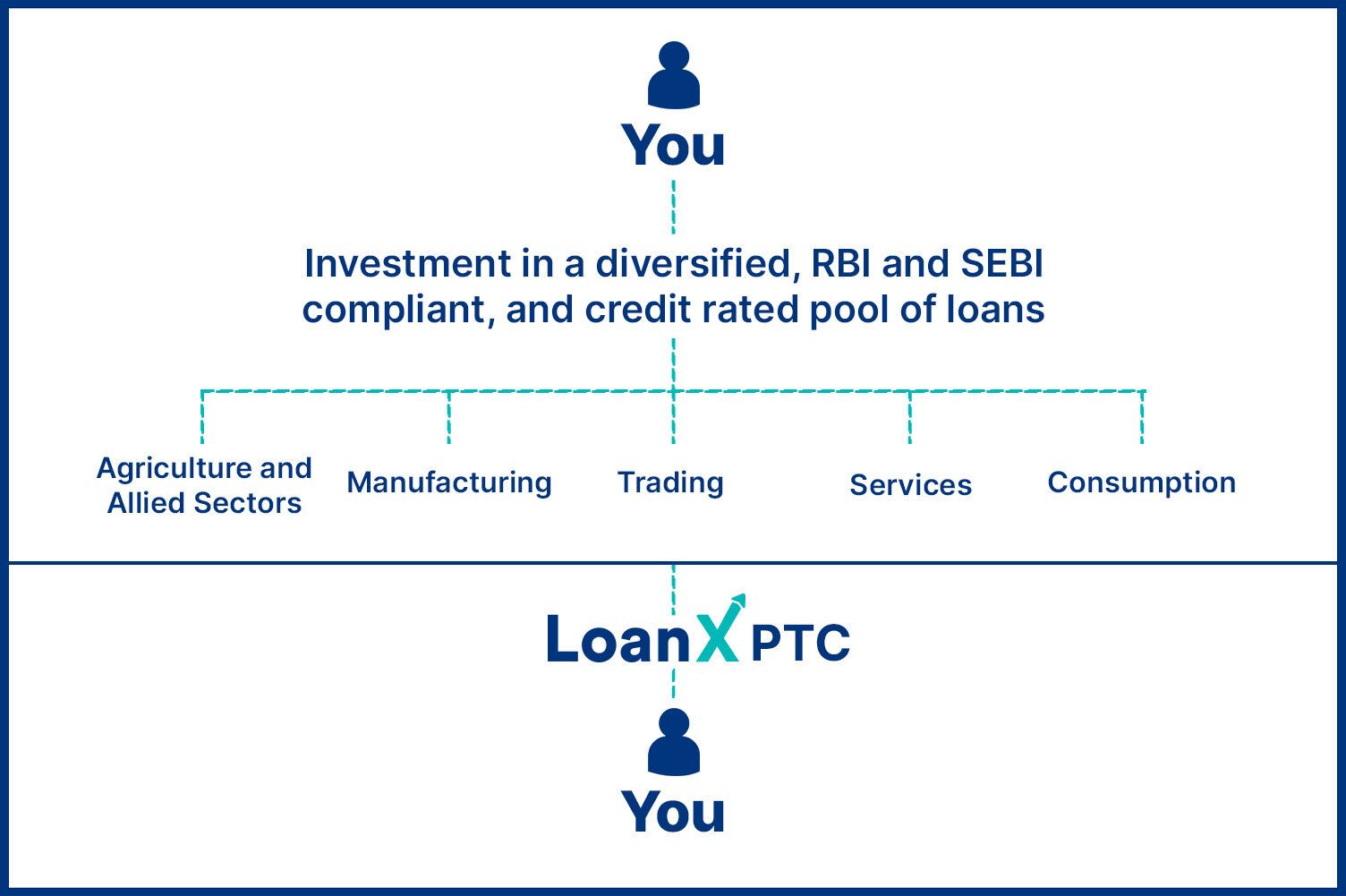

Like all products on Grip, LoanX is a regulated, rated, and listed (on BSE/ NSE) investment option. As an investor, LoanX gives you the following:

- Exposure to a diverse pool of loans (in fact - we have clubbed together 2,450+ loan accounts in the first LoanX) to diversify your risk

- SEBI and RBI-compliant structure

- Credit-rated instrument for higher transparency and easier understanding of risk

- Listed on BSE/ NSE and held in your Demat account, with returns received directly into your bank account

- Monitored by a SEBI-registered trustee

- Additional security measures include a fixed deposit to protect up to 20% of the investment value

How Does LoanX Work?

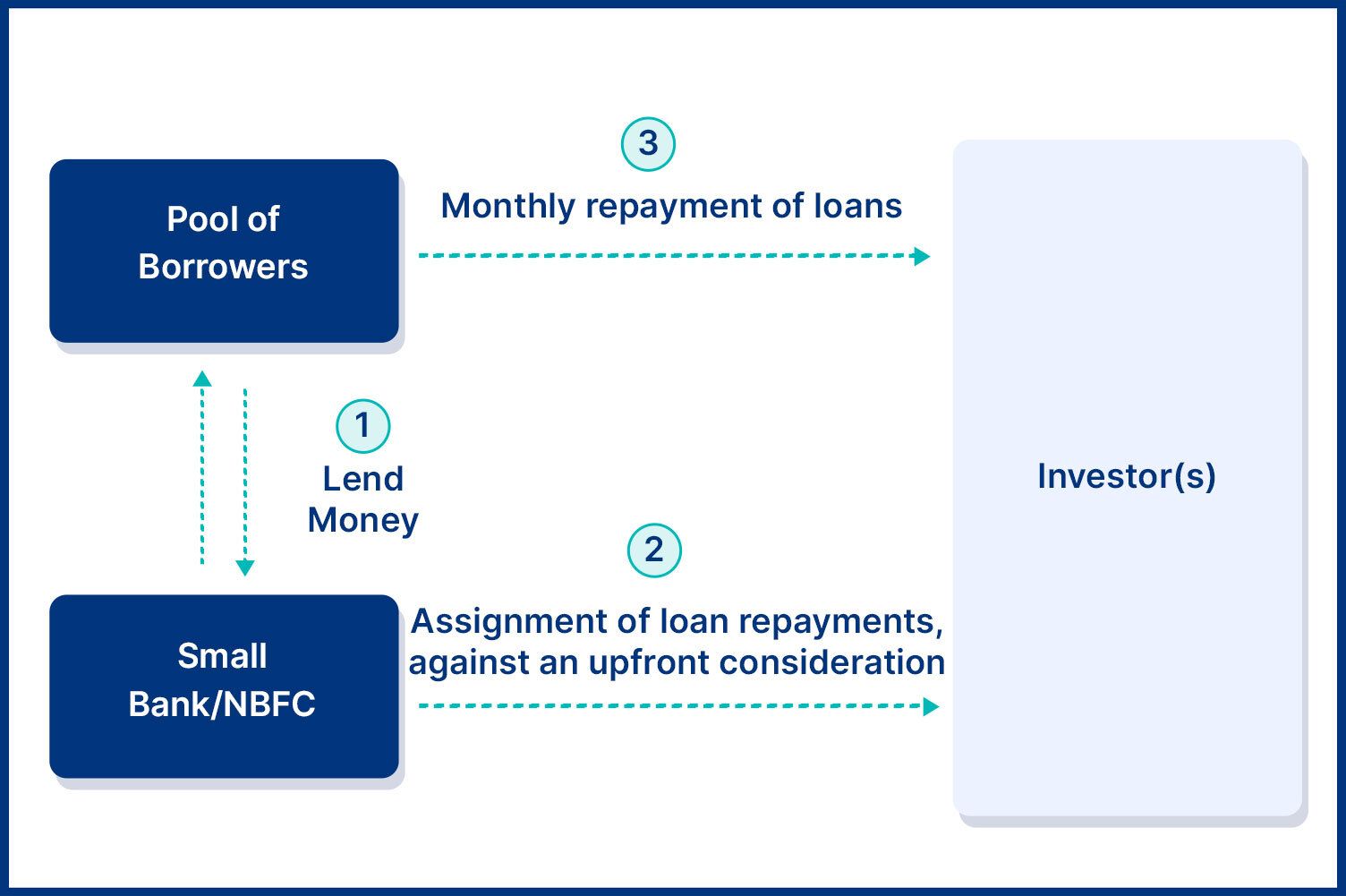

With LoanX, each opportunity entails receiving returns from a pool of a large number of loans provided to individuals, businesses, or other entities. As depicted below, these loans have been provided by a NBFC and you as an investor get direct access to the returns these loans generate.

Transaction Structure

The future interest or returns from these thousands of loans are packaged together and those are assigned to a dedicated trust created for this investment. The trust purchases these receivables using monies received from the investors (like you), and against this investment, the investors are paid back the monthly interest and principal amount.

The Trust is managed by an independent, SEBI registered Trustee to provide an additional layer of security and independent monitoring.

Additionally, only the interest component is expected to be taxed in the hands of the investor based on individual investors' marginal tax rate. Over the course of the tenure, investors receive their complete principal amount along with interest in periodic installments.

What Makes LoanX Different From Other Alternative Assets?

LoanX not only offers all the benefits of alternative investments but also has the X factor of being:

(a) investment grade and rated by an external credit rating agency

(b) diversified across multiple borrowers in different industries/locations

(c) compliant with SEBI and RBI guidelines

On the other hand, a similar alternative asset, P2P lending is not a rated investment option and is also offered by non-regulated P2P lending platforms. Recently, On August 16, 2024, the RBI issued a new circular that further tightens the rules governing P2P lending. Under these new regulations, P2P platforms can no longer assume credit risks, offer guarantees, or market their services as investments2. Hence, LoanX becomes a better alternative than P2P lending due to its structure that is compliant with SEBI and RBI guidelines.

In conclusion, LoanX by Grip presents a more streamlined approach towards short tenure, fixed income, and regulatory-compliant products, enabling investors access to new investment opportunities which until now were available to only a select few.

Learn more about LoanX through this short video. Click here!

References:

- CRISIL Ratings <https://tinyurl.com/zcyrsszd>

- RBI <https://tinyurl.com/mr3v4448>

Want to stay at the top of your finances? Don’t forget to sign up!

Join the community of 4 lakh + investors and learn more about Grip, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer: This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip Invest Technologies Private Limited ("Grip", formerly known as Grip Invest Advisors Private Limited) is not registered with SEBI in any capacity and does not advise, encourage, or discourage its users to invest or not invest in any securities. Grip is solely an execution-only platform and does not guarantee or assure any return on investments made by you in any opportunities sourced by Grip and accepts no liability for consequences of any actions taken based on the information provided. Your investment is solely based on your judgement. Investments in debt securities are subject to risks. Read all the offer-related documents carefully.