Decoding Asset Leasing: Meaning, Benefits, Models And More

In this constantly changing financial landscape, savvy investors are increasingly looking for smarter ways to maximise their returns.

Asset leasing is an alternative investment that has gained immense traction of late.

Whether you are a seasoned investor looking for a fresh perspective or a newcomer wanting to explore new avenues, this alternative investment can be a great option. Let us dive into the basics of asset leasing, how it works, and its benefits in detail in this article.

What Is Leasing?

For the longest time, the term ‘Leasing’ was used only in terms of real estate. We must have heard our parents discussing leasing out properties and we interchangeably use ‘renting’ and ‘leasing’. But what is asset leasing exactly?

Leasing is an agreement between a lender, the lessor, and a borrower, the lessee. The owner of the asset, typically an individual or a company, leases the asset to the borrower for a specific period and at a certain cost. The lessee is provided exclusive use of the asset in exchange for periodic payments throughout the agreed-upon lease term.

Asset Leasing As An Alternative Investment Option

Let us clarify: this investment option has existed for quite a while; it is not a new product. However, earlier, it was only accessible to certain high net-worth individuals (HNIs) or institutional investors.

In recent years, asset leasing has emerged as an attractive, fixed-income and new-age option for retail investors through platforms like Grip Invest.

Benefits Of Asset Leasing

- Fixed Income: Investors can receive stable returns over the life of the lease. Returns are fixed and are generally not subject to market fluctuations. For example, LeaseX by Grip Invest, a listed and regulated debt instrument, offers up to 14% pre-tax IRR.

- Passive Income: Traditional investments like stocks often require active management, like studying the markets and watching the stock prices. On the other hand, asset leasing is a “low-effort investment”. It is great for investors looking for fixed passive income.

- Easy Diversification: One of the benefits of asset leasing is that it enables investors to diversify their portfolios. Suppose you already own some stocks or bonds - adding asset leasing to your portfolio spreads the risk. In some options like LeaseX, there is usually exposure to multiple lessees across different industries, further diversifying your investment.

- Multiple Tenure Options: There are a variety of opportunities available in this alternative investment. From long-term to short-term, you can choose from many options that align best with your financial goals and investment horizon.

How Different Asset Leasing Models Work?

Nowadays, quite a few platforms in the market provide exposure to asset leasing. Two of the popular models they follow are explained below:

- Securitised Debt Instruments (SDI): SEBI introduced SDI in 2008 in India1. LeaseX by Grip Invest is an asset leasing opportunity structured as an SDI. It is an exchange-listed, credit-rated, SEBI- and NSE-regulated debt instrument that gives investors access to fixed monthly returns.

The structure looks somewhat like this:

In simple words, the “originator” (usually an NBFC) owns the asset and leases it to the Lessee(s), who then makes the monthly interest and principal repayment to the originator. The returns are then distributed to investors in proportion to the amount invested.

All this is managed and monitored by an independent SEBI registered trustee, making the process secure!

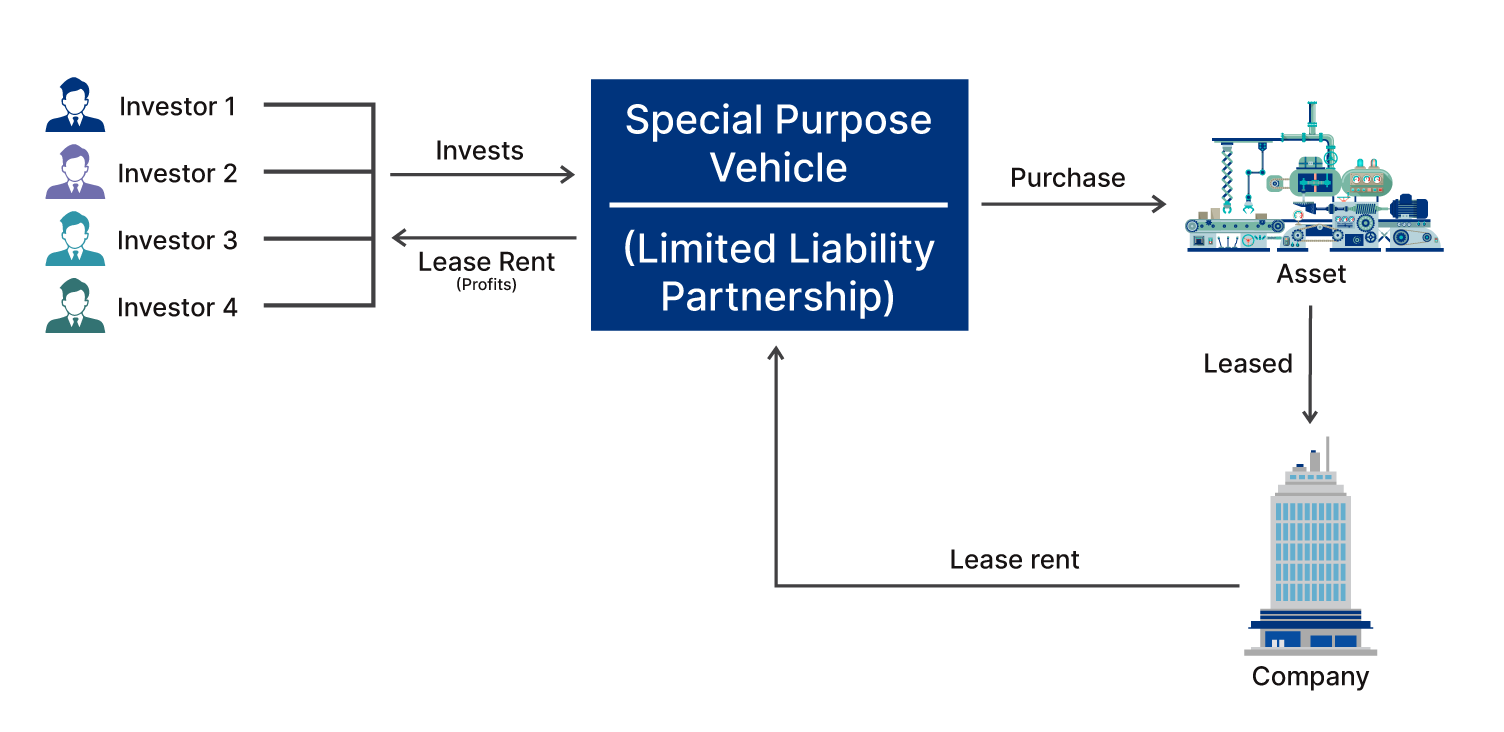

- Limited Liability Partnership (LLP) Model: It works when the investor contributes funds to a Specific Purpose Vehicle (SPV) as a Limited Liability Partnership. It is an unrated, unlisted and unregulated format. The investors become partners in this LLP, and their ownership stake represents their invested amount.

LLP Model Of Asset Leasing

The SPV then purchases an asset, such as equipment, for use by the company it invests in. This investment is leased back to the company at a predetermined rate of return. All the partners in the vehicle receive lease payments from the asset in proportion to their ownership stake.

Why Do Companies Go For Leasing Rather Than Purchasing Assets?

Asset leasing offers companies a cost-efficient and convenient way to access the latest technology and equipment. Using this option, businesses can enjoy significant savings while ensuring access to the best possible resources. Here are three reasons why companies choose to lease:

- Less Initial Investment: It allows companies to acquire the necessary equipment without a large initial investment. It makes it an appealing choice for businesses of any size, from start-ups to well-established corporations.

- Flexibility: It allows companies to easily adapt to changing business needs and requirements. It helps them remain operationally and technologically competitive by upgrading their assets every 1-5 years.

- No Ownership Risk: Leasing assets reduces the risk of owning expensive items. Asset leasing is a great way to test new equipment before purchasing outright.

Additionally, leasing helps businesses optimize cash flow and allocate resources efficiently. Instead of tying up capital in depreciating assets, companies can use their funds for growth, innovation, and strategic investments.

For businesses looking to further optimize their financial strategy, corporate bonds offer a stable, fixed-income investment option. By investing in high-rated corporate bonds, you can generate steady returns while diversifying your portfolio.

Conclusion

In conclusion, asset leasing can be a great addition to your portfolio if you seek stable returns and diversification. However, do not forget that every investment comes with its own risk. Analyse the investment carefully and select the one that best aligns with your portfolio, financial goals and risk tolerance. Explore Grip Invest and discover various asset leasing investments to diversify your portfolio.

Frequently Asked Questions

- What Is IRR?

IRR (Internal Rate of Return) is a measure that represents the amount of money earned on an investment. It assumes that payouts are reinvested at the same rate. It is considered a good measure when receiving monthly/quarterly returns. - Can I Invest In Asset Leasing Through The Exchange?

Grip Invest recently became the first OBPP platform to integrate NSE’s RFQ (Request For Quote) mechanism for fixed-income instruments like LeaseX. This mechanism ensures all investments made in LeaseX on Grip are directly executed/settled via the stock exchange. - What Are Securitized Debt Instruments (SDIs)?

These financial products pool together assets like leases, loans, etc. and repackage them into securities. These securities can then be sold and bought in the financial markets.

References:

- Securities and Exchange Board of India (SEBI) <https://tinyurl.com/2d4z99mu>

Want to stay at the top of your finances?

Join the community of 2.5 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities are subject to risks. Read all the offer-related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading. This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip Invest”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip Invest or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip Invest does not guarantee or assure any return on investments and accepts no liability for the consequences of any actions taken based on the information provided. For more details, please visit https://www.gripinvest.in/.

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001.