How IIFL Samasta Is Empowering Women And Driving Financial Inclusion Across India

Introduction To IIFL Samasta

Headquartered in Bengaluru, IIFL Samasta is a Non-Banking Financial Company (NBFC) that primarily focuses on providing Microfinance (MFI) Loans, Two-Wheeler Loans, and Individual Loans. It serves a wide customer base across India, particularly helping underserved segments access affordable credit. In 2017, the company gained fresh momentum when IIFL Finance, a listed financial services provider known for its diversified lending and mortgage solutions, acquired management control of Samasta. Since then, IIFL Finance has invested significantly in the company and now holds a 99.56% stake, driving strong and consistent growth.

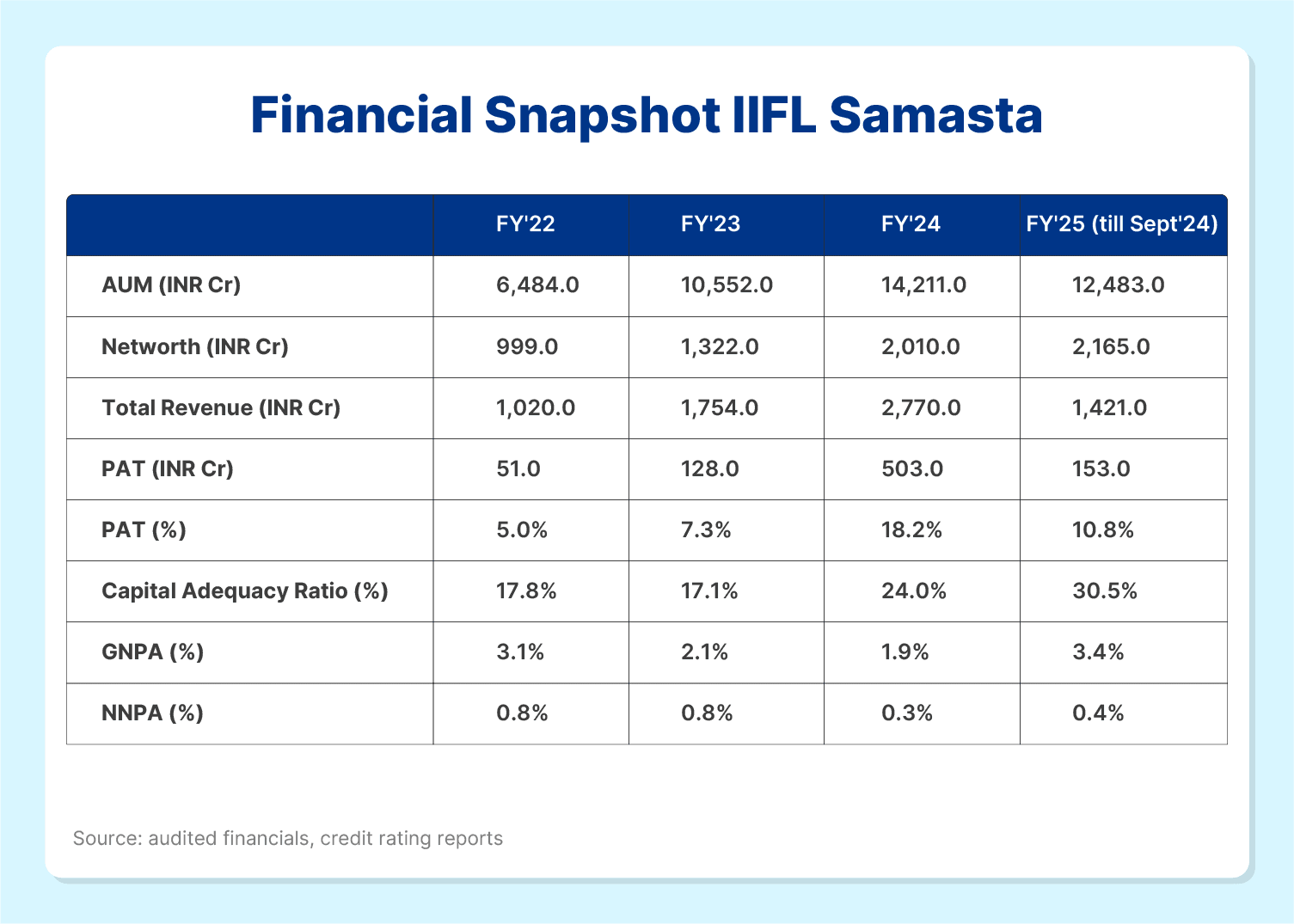

With over 29.4 lakh borrowers reached through 1,645 branches spread across 22 states, IIFL Samasta has built a well-diversified and widespread operational network. The company has a balanced regional footprint, with 31% of its business in the North, 30% in the West, 26% in the South, and the remaining across other parts of the country. Its performance over the last three years has been remarkable, recording a compound annual growth rate (CAGR) of 40.0% in Total AUM, 712.0% in Profit After Tax (PAT), 150.0% in Net Worth, and 207.0% in Total Revenue. This impressive trajectory highlights IIFL Samasta’s role as a rapidly expanding player in the Indian lending landscape.

Board Of Directors Of IIFL Samasta

As of per the latest information, the Board of Directors of IIFL Samasta includes:

- Dr. Govinda Rajulu Chintala – Chairman of the Board, Additional (Independent Director)

- Mr. Kalengada Mandanna Nanaiah – Additional (Independent Director)

- Mr. Nihar N Jambusaria – Additional (Independent Director)

- Mr. R. Venkataraman – Additional (Non-Executive Director)

For more detailed information, please refer to the official governance documentation of IIFL Samasta.

Source: IIFL Samasta1

Products Offered By IIFL Samasta

?IIFL Samasta offers a diverse range of financial products tailored to meet the needs of various customer segments. Below is a detailed overview of their offerings:?

Microfinance Loans

1. Samriddhi – Income Generation Loan

Designed to empower women entrepreneurs, this loan provides capital for establishing or expanding microenterprises. It caters to needs such as boosting working capital and acquiring inventories.

- Lending Model: Joint Liability?

- Loan Amount: INR 25,000 - INR 80,000?

- Tenure: 12-36 months?

- Repayment Frequency: Monthly/Fortnightly/Bi-monthly?

- Rate of Interest: 22.99% - 23.99%?

- Processing Fee: 1.5% + GST?

2. Samriddhi Plus – Income Generation Loan

An extension of the Samriddhi loan, offering higher loan amounts to support larger business expansions and increased working capital needs.

- Lending Model: Joint Liability?

- Loan Amount: INR 80,000 - INR 1.25 lakhs?

- Tenure: 24-36 months?

- Repayment Frequency: Monthly/Fortnightly/Bi-monthly?

- Rate of Interest: 22.99% - 23.99%?

- Processing Fee: 1.5% + GST?

3. Samvardhana – Top-Up Loan

Offers additional funds to existing business loan customers with a solid repayment track record, enabling further enhancement of their income-generating activities.

- Lending Model: Joint Liability?

- Loan Amount: INR 15,000 – INR 35,000?

- Tenure: 12-24 months?

- Repayment Frequency: Monthly/Fortnightly/Bi-monthly?

- Rate of Interest: 22.99% - 23.99%?

- Processing Fee: 1.5% + GST?

4. Sajal – Water and Sanitation Loan

Provides affordable credit to customers for essential sanitation and hygiene improvements, such as installing water connections, constructing toilets, and setting up filtration units.

- Lending Model: Joint Liability?

- Loan Amount: INR 15,000 – INR 35,000?

- Tenure: 12 – 24 months?

- Repayment Frequency: Monthly/Fortnightly/Bi-monthly?

- Rate of Interest: 22.99% - 23.99%?

- Processing Fee: 1.5% + GST?

5. Suvidha – Consumer Product Loan

Aims to enhance customers' lives by providing access to transformative products such as cook stoves, mixer grinders, water purifiers, solar lights, and mobile phones.

- Lending Model: Joint Liability?

- Loan Amount: INR 1,000 - INR 25,000?

- Tenure: 9-18 months?

- Repayment Frequency: Monthly/Fortnightly/Bi-monthly?

- Rate of Interest: 22.99% - 23.99%?

- Processing Fee: Nil?

Non-Microfinance Loans

1. Pragati – Mortgage Loan

Crafted to facilitate easy credit access for Micro, Small, and Medium Enterprises (MSMEs), supporting job creation and income generation.

- Lending Model: Individual?

- Loan Amount: INR 3 lakhs - INR 25 lakhs?

- Tenure: 24-120 months?

- Repayment Frequency: Monthly?

- Rate of Interest: 19% - 21%?

- Processing Fee: 2% + GST?

2. Sampark – Mortgage Loan

Similar to Pragati, this loan supports MSMEs by providing credit access for business promotion and expansion.

- Lending Model: Individual?

- Loan Amount: INR 3 lakhs - INR 15 lakhs?

- Tenure: 24-120 months?

- Repayment Frequency: Monthly?

- Rate of Interest: 21% - 23%?

- Processing Fee: 2% + GST?

3. Sampark Advantage – Mortgage Loan

Designed to provide easy credit access to MSMEs, facilitating their growth and development.

- Lending Model: Individual?

- Loan Amount: INR 60,000 - INR 5 lakhs?

- Tenure: 12-72 months?

- Repayment Frequency: Monthly?

- Rate of Interest: 23% - 26%?

- Processing Fee: 2% + GST?

4. Swabhimaan – Micro Enterprise Loan

An unsecured loan designed to offer financial support to rural micro-enterprises, promoting entrepreneurship and economic development.

Empowering Women Through Inclusive Financial Solutions

At the heart of IIFL Samasta’s mission is a strong commitment to empowering women, especially those from low-income and underserved communities. The company focuses on providing accessible and affordable financial services tailored to the needs of women, helping them gain financial independence and build a better future for themselves and their families. By offering group loans, individual business loans, and other need-based credit products, IIFL Samasta enables women to start or expand small businesses, invest in education, healthcare, or housing, and become active participants in the economy.

This women-centric approach is reflected in their operational model as well. The company ensures that its services are delivered in a respectful, transparent, and culturally sensitive manner. Field officers often engage directly with women borrowers through group meetings and financial literacy sessions, fostering trust and confidence. With a wide presence across rural and semi-urban regions, IIFL Samasta continues to bridge the credit gap and promote inclusive growth, making a real impact on the lives of millions of women across India.

Key Strengths Of IIFL Samasta

Key Strengths of IIFL Samasta (Simplified)

1. Steady Growth in AUM

Over the past three years, IIFL Samasta has grown strongly, with its Assets Under Management (AUM) rising at an annual rate (CAGR) of 40%. As of September 2024, the company’s total AUM stands at INR 12,483 crore, showing its ability to scale up operations consistently.

2. Diverse Sources of Funding

The company has built strong relationships with more than 40 banks, over 15 NBFCs, and several other financial institutions. This has helped them maintain a healthy mix of funding sources. Their current funding breakdown includes Term Loans (53%), Refinance (7%), Non-Convertible Debentures or NCDs (10%), Tier II Capital (5%), Commercial Papers (1%), Direct Assignments or DA (21%), and Pass Through Certificates or PTCs (3%).

3. Strong Capital Support

As of the first half of FY25, the company’s capital position remains healthy, with a net worth of INR 2,165 crore. Their parent company has regularly infused capital to support growth—most recently, INR 200 crore was added in FY24. This backing ensures the company can continue expanding while staying financially stable.

4. Rapid Rise in Profitability

IIFL Samasta has been improving its profitability over time. Its Profit After Tax (PAT) margin increased from 5.0% in FY22 to 18.2% in FY24, and stood at 10.8% in the first half of FY25. This growth shows that the company is managing its business well and generating more profit from its operations.

5. Balanced Loan Portfolio

The company’s loan book is spread across various products like gold loans, home loans, and loans against property (LAP). This diversification helps reduce risk and maintain stability. Even when the gold loan segment—a high-profit area—was temporarily shut down due to regulatory issues, the company’s overall performance stayed strong.

Source: CRISIL2

Financial Snapshot IIFL Samasta

Source: Source: audited financials, credit rating reports

To arrange the capital, IIFL Samasta also offers corporate bonds. These opportunities from the company are secured and are rated by credit rating agencies. On Grip Invest, investors invested in CRISIL ‘AA’ rated bonds of the company that offered fixed returns of up to 10.8%. To invest in similar, rated, regulated and secured fixed-income opportunities sign-up for Grip Invest today and start earning fixed returns:

References:

1. IIFL Samasta, accessed from: https://rb.gy/mvvq7i

2. CRISIL Ratings, accessed from: https://rb.gy/qh8i3r.

Want to stay at the top of your finances?

Join the community of 4 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks, and shenanigans in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading.

This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for consequences of any actions taken based on the information provided. For more details, please visit www.gripinvest.in

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001