How Power Finance Corporation Is Fueling India's Energy Future

Introduction To Power Finance Corporation Ltd.

Power Finance Corporation Limited (PFC) is one of India’s most important financial institutions in the infrastructure space. Established in 1986, it is the largest Non-Banking Financial Company (NBFC) in the country by net worth and plays a key role in powering India’s growth, quite literally. PFC provides much-needed financial support to companies involved in electricity generation, transmission, and distribution. Backed by the Ministry of Power, Government of India, PFC helps fund large-scale infrastructure projects that are critical for the country's energy security and development.

In October 2021, PFC was granted the status of a Maharatna Central Public Sector Enterprise (CPSE), a title that gives its Board more freedom to make large investment decisions without needing prior government approval. This allows the company to move faster when setting up new subsidiaries, forming joint ventures, or making acquisitions. With a market capitalisation of INR 1.3 trillion as of May 2025, and the Government of India owning a 56% stake, PFC continues to play a leading role in shaping the future of India’s power sector.

Board Of Directors Of Power Finance Corporation Ltd.

Here is the list of Board of Directors of PFC, along with their designations:

- Smt. Parminder Chopra – Chairman & Managing Director

- Shri Rajiv Ranjan Jha – Director (Projects)

- Shri Manoj Sharma – Director (Commercial)

- Shri Sandeep Kumar – Director (Finance)

- Shri Shashank Misra – Director (Government Nominee)

- Smt. Usha Sajeev Nair – Independent Director

- Shri Prasanna Tantri – Independent Director

- Shri Naresh Dhanrajbhai Kella – Independent Director

- Shri Bhaskar Bhattacharya – Independent Director

- Shri Sudhir Mehta – Independent Director

Source: PFC1

Products Offered By Power Finance Corporation Ltd.

1. Term Loans

PFC provides long-term financial assistance to projects in power generation (thermal, hydro), transmission, and distribution. These loans also cover related activities such as surveys, investigations, plant renovations, and energy conservation programmes. The loan amount can range from 70% to 100% of project costs for central and state utilities, and 20% to 50% for private-sector projects. The repayment structure includes flexible moratorium and maturity periods tailored to each project’s scope.

2. Lease Financing

Under this scheme, PFC finances 100% of the cost when utilities need to purchase essential equipment or machinery for power projects. Lease terms typically range from 3 to 10 years, offering a viable alternative for asset acquisition without immediate capital outlay.

3. Bill Discounting (Direct Discounting Of Bills)

This financing solution allows equipment manufacturers to receive prompt payment by discounting accepted bills from utility customers. PFC buys these bills, granting manufacturers immediate liquidity while end buyers enjoy deferred payment options, one of PFC’s earliest non-project solutions.

4. Guarantee Services

To support the power sector’s large funding needs, PFC guarantees loans raised by utilities from other financial institutions. PFC’s guarantee can cover up to 15% above the sanctioned term loan limit, enhancing borrower access and lender confidence.

5. Loan Syndication

PFC arranges syndication with other financial institutions such as IFCI and ICICI to co-finance large-scale projects. This enables efficient fund mobilization and institutional collaboration on major infrastructure developments.

6. Short-Term Loans

Designed for utility companies needing working capital, PFC’s short-term loan window provides finance of up to INR 300 crore with a repayment term between 30 to 360 days. These loans help manage liquidity and operational expenses effectively.

7. Green And Renewable Energy Financing

PFC supports projects in solar, wind, and hydro-renewable energy, as well as energy efficiency and clean energy technology. It offers interest rate rebates (e.g., 10–50 bps for domestic content, government guarantees, solar projects) to incentivize sustainable investment. It has also raised significant funds through green bonds in the international and domestic market.

8. Capital Gains Bonds (Section 54EC)

PFC issues five-year, tax-free capital gains bonds under Section 54EC of the Income Tax Act, offering safe fixed-income instruments with high credit quality, ideal for investors looking to save tax and earn secure returns.

9. Consulting And Institutional Development Services

Beyond lending, PFC offers advisory support including utility reforms, operational and financial action plans (OFAPs), and capacity building via grants and concessional loans. It also conducts studies for restructuring, demand management, and energy conservation.

10. Support For Government-Backed Schemes

PFC actively supports several national initiatives such as Ultra Mega Power Projects (UMPPs), R-APDRP, National Smart Grid Mission, and state-level power sector reform programmes, positioning itself as the nodal financial agency for large-scale infrastructure schemes.

Source: Power Finance Corporation Ltd.2

Power Finance Corporation Ltd. Customer Care

For any investment related queries or support, Power Finance Corporation Ltd’s customer care team is here to help. You can reach them at 1800-11-5080 or email: 54ECAllotment@pfcindia.com

Powering India’s Growth With Trusted Government-Backed Financing

Power Finance Corporation Ltd. (PFC) stands at the heart of India’s power sector development. Backed by the Government of India, which holds a 56% stake, PFC provides crucial funding to infrastructure projects across power generation, transmission, and distribution.

Its Maharatna status gives it greater autonomy and strategic agility, allowing quicker decisions and broader investment capabilities. With a market leadership position and strong government support, PFC plays a vital role in accelerating India's energy goals through reliable, large-scale financial assistance.

Also Read: How Midland Microfin Is Empowering Rural Women Through Group Lending

Key Strengths Of Power Finance Corporation Ltd.

Key Strengths Of Power Finance Corporation Ltd. (Simplified)

1. Plays A Key Role In Government Policies

PFC is an important arm of the Government of India (GoI) when it comes to implementing power-related policies. It helps fund major power projects, especially those led by state and central government utilities. Its support is crucial in achieving the country’s energy goals.

2. Backed By The Government Of India

The Government of India holds a majority stake in PFC, 56%. This strong government ownership means PFC receives significant backing, both financially and operationally. For example, the company has been allowed to issue capital gains tax-exempt bonds, which helps it raise money more easily and affordably.

3. India’s Largest Power Sector Lender

PFC is the biggest lender to the power sector in India, on a consolidated level. It plays a central role in financing State Power Utilities (SPUs) and other power-related infrastructure. In fact, its total loan book saw an impressive 20% growth year-on-year, reflecting its dominant market position.

4. Strong Capital Base

As of September 2024, PFC had a Capital Adequacy Ratio (CAR) of 24.9%, showing that the company has enough capital to cover its lending risks. This strong financial cushion ensures that PFC can continue lending and growing steadily. The company has also shown that it can raise funds through public issues whenever needed, which supports its capital strength in the long run.

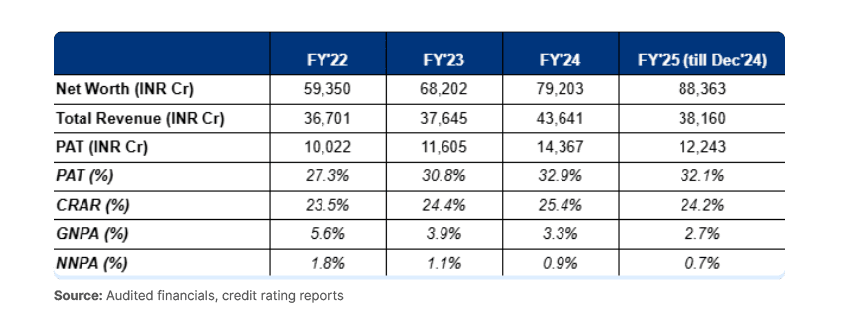

Financial Snapshot Power Finance Corporation Ltd.

Source: Source: audited financials, credit rating reports

To arrange the capital, Power Finance Corporation Ltd. also offers corporate bonds. These opportunities from the company are secured and are rated by credit rating agencies. On Grip Invest, investors invested in CREDIT ‘AAA’ rated bonds of the company that offered fixed returns of up to 5.36%. To invest in similar, rated, regulated, and secured fixed-income opportunities, sign up for Grip Invest today and start earning fixed returns:

References:

1. Power Finance Corporation Ltd., accessed from: https://www.pfcindia.co.in/ensite/BoardofDirectors#:~:text=Smt.,Previous

2. Power Finance Corporation Ltd., accessed from: https://www.pfcindia.co.in/ensite/Home/VS/10

Want to stay at the top of your finances?

Join the community of 4 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks, and shenanigans in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities/municipal debt securities/securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading.

This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for consequences of any actions taken based on the information provided. For more details, please visit www.gripinvest.in

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001