P2P Lending Vs. LoanX: Which Option Is Best For You?

In the present investing world, where accessibility, convenience, and tailored solutions are at the forefront, investors have turned to alternative lending. The global alternative lending platform market is estimated to reach $30.15 billion by 2033 with a 24.1% CAGR1. Approximately 40% of retail customers believe a non-banking institution will provide better investment services2.

The sudden yet anticipated increase in alternative lending has given rise to some promising and innovative investment instruments. The choice between these offerings has become complex as investors look for options beyond traditional investments.

We will discuss about two of the options in this space: peer-to-peer (P2P) lending and LoanX. So, what should you choose between the two? Read the article to determine the most-suited alternative lending option per your investment goals and risk profile.

Growing Need For Alternative Lending Options

Alternative lending refers to the range of loan options for consumers and business owners outside conventional bank loans. Simply put, it means borrowing loans from non-banking financial institutions without a full banking license.

Below are reasons for the rising demand for alternative lending solutions:

- Technological Advancements: Technological innovations have revolutionised lending processes. Non-banking institutions leverage data analytics and artificial intelligence to evaluate creditworthiness and accelerate the process.

- Changing Consumer Preferences: Lending platforms provide lenders and borrowers with a personalised and convenient experience. Alternative investors allow quick access to funds with streamlined application procedures, faster approvals, and seamless interactions.

- Flexibility And Accessibility: Traditional banks follow rigorous eligibility criteria. Alternative lending offers a more inclusive approach and flexible terms that cater to diverse participants.

What Is Peer-To-Peer (P2P) Lending?

Peer-to-peer lending or Marketplace Lending is among the most popular alternative lending solutions. It uses an online platform to match investors with borrowers. In essence, P2P lending refers to direct money lending to businesses or individuals without an intermediary.

Advantages Of P2P Lending

Peer-to-peer lending offers several compelling advantages for lenders and borrowers. Besides the streamlined process, the following benefits make it an attractive alternative to traditional financing methods:

- High Returns: Peer-to-peer lending platforms operate online and eliminate associated overhead costs. It directly connects lenders with borrowers and allows flexible interest rates. Therefore, you can expect higher returns than traditional savings accounts and bonds.

- More Transparent: P2P lending platforms provide transparent information about borrowers, loan terms, and credit ratings. You can review relevant details and tune your investment depending on your preference and market conditions.

- Versatility In Loan Purposes: P2P lending caters to various purposes and offers many choices. You can lend funds to support MSME businesses, facilitate property portfolio growth, or finance housing developments.

Disadvantages Of P2P Lending

Nothing comes without limitations, and P2P lending is no exception. Some notable downsides to engaging with the market include

- Credit Risk: P2P loans are highly exposed to credit risks. Therefore, you must assess the creditworthiness and learn about the default probability of the counterparty.

- No Insurance: Peer-to-peer lending is not protected. The government offers no protection or insurance if the borrower is a fraud or fails to pay his/her loans.

- Tax Complexity: P2P lending accompanies complex and varying tax implications. You may need to navigate with tax laws for interest income and potential losses.

What Is LoanX?

LoanX is an investment-grade solution for a streamlined approach to gaining fixed income from short-term investments. It is a regulated and NSE/BSE-listed instrument and allows you to tap into unexplored investment opportunities. LoanX introduces a robust framework to secure your investment interest.

Advantages Of LoanX

Although new to the market, LoanX is distinctly positioned to offer a range of benefits. It ensures every investor can access favourable investment opportunities to curate diversified and healthy portfolios. The primary perks of LoanX investment are as follows:

- Risk Diversification: LoanX provides access to a diversified pool of loans given to various industries. The credit-rated instrument helps you diversify the risk across various loans, with the first one being formed with over 2450 loan accounts

- Compliant And Transparent: LoanX complies with the SEBI and RBI guidelines. Further, its transparency gives you a clear picture of your returns and re-payments. It helps you align your investments with your financial goals and risk tolerance.

- Highly Secured: An independent SEBI-registered trustee manages the LoanX working process. It includes a fixed deposit to protect up to 20% of the investment value and facilitate risk mitigation.

Disadvantages Of LoanX

LoanX is a structured investment solution that harbours a compliant framework. However, it is not immune to inherent risks with any investment. The potential drawbacks include:

- Market Volatility: While LoanX diversifies risk, external factors like economic downturns or changing market conditions can significantly impact the performance of the underlying loans.

- Regulatory Changes: Regulatory guidelines may influence the structure and operation of LoanX. Variations or adjustments in regulations might affect tax implications and investment viability.

- Credit Risk: The performance of LoanX investment is closely tied to how the loans perform. It may bring negative returns if several loans underperform or default.

How To Choose Between P2P Lending And LoanX?

Selecting between P2P lending and LoanX can be challenging due to their unique advantages. Here are the factors you must consider for the ideal option

- Risk Tolerance: Alternative lending solutions carry varying risk degrees. They may involve higher default rates and affect your returns. Hence, assess your comfort level with risk before choosing a lending option.

- Security: Regulations and guidelines can impact your rights and protections. Therefore, learning about the regulatory framework governing P2P lending and LoanX solutions is essential.

- Access To The Market: Consider the accessibility level each option provides to different markets or segments. For example, P2P lending exposes you to individual borrowers or small businesses, while LoanX could give access to various industries or sectors.

- Investment Horizon: Determine how long you want to tie up your funds to identify suitable tenure. Some lending options may have shorter loan terms, while others could be longer-term investments.

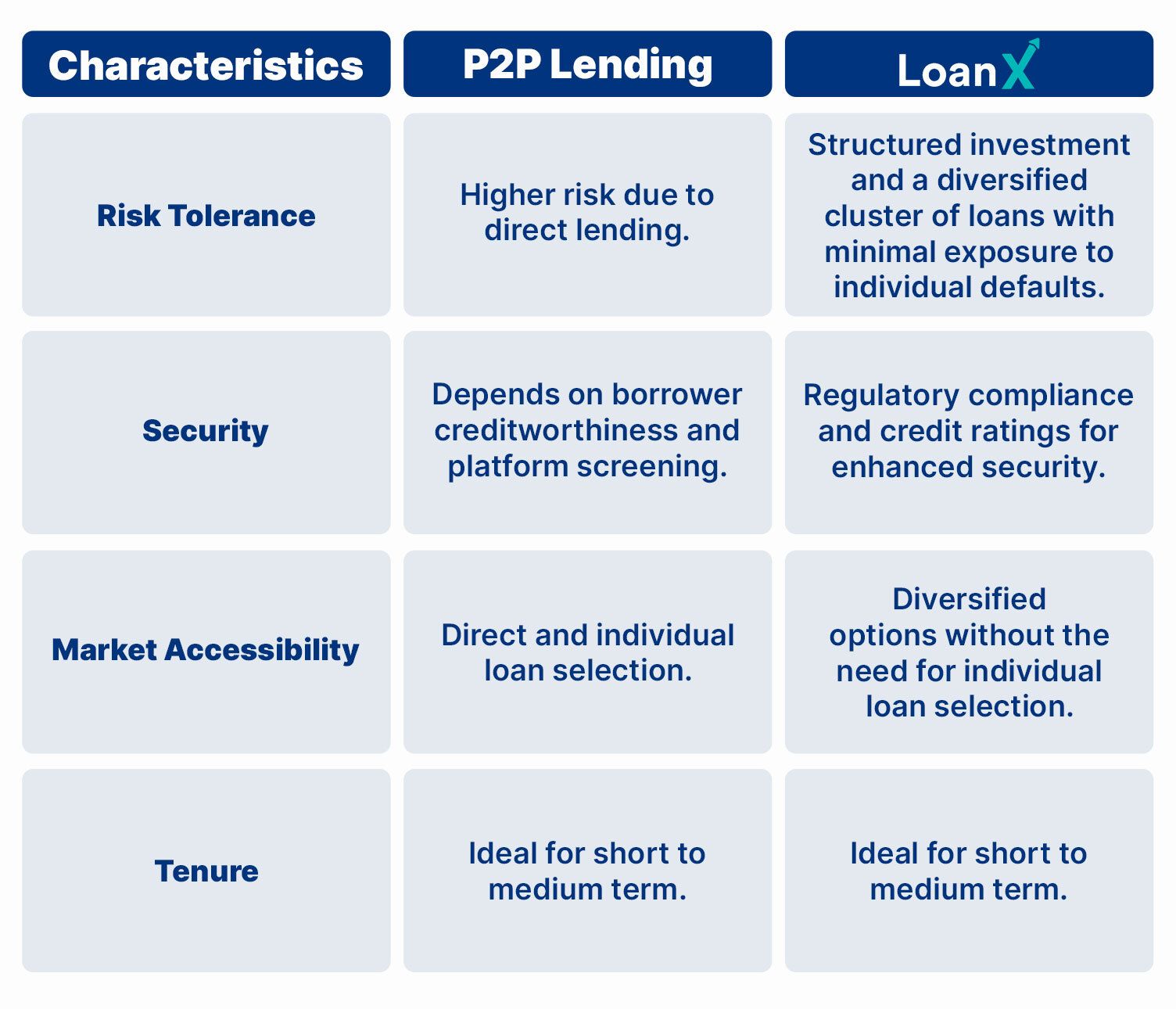

Here is a tabular comparison between P2P lending and LoanX to help you make an informed choice.

The Reserve Bank of India (RBI) has been closely monitoring P2P lending platforms and their practices. On August 16, 2024, the RBI issued a new circular that further tightens the rules governing P2P lending. Under these new regulations, P2P platforms can no longer assume credit risks, offer guarantees, or market their services as investments3. Lenders must bear all risks of losses, and platforms are prohibited from using lender funds to cover others' obligations. These measures by the RBI aim to protect investors' interests. You should keep yourself updated with such developments in the industry to make informed decisions on your investment strategy.

The Bottom Line

Ultimately, the right choice depends on your financial goals, risk tolerance, and preferences. It is wise to conduct thorough research and start with a minimum investment to test the waters before committing significant funds.

The versatile peer-to-peer lending allows you to diversify your portfolios across various loan types and enhances risk management. However, the actual returns can be uncertain and unreliable. Meanwhile, LoanX provides compliance and grants exposure to a diversified pool. The additional security measures enhance investor confidence.

Grip offers an easy-to-use platform to participate in alternative investments. It presents various solutions and products to help you meet your financial goals. Explore Grip Invest to begin your journey today and explore LoanX as an alternative investment option.

References:

- Future Market Insights <https://tinyurl.com/3ky84v7f>

- Business Insider <https://tinyurl.com/yn339v9x>

- RBI <https://tinyurl.com/mr3v4448>

Want to stay at the top of your finances?

Join the community of 4 lakh+ investors and learn more about Grip, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities are subject to risks. Read all the offer-related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading. This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for the consequences of any actions taken based on the information provided. For more details, please visit https://www.gripinvest.in/.

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001.