Key Differences Between Secured And Unsecured Bonds For Investors

Corporate bonds have long been a go-to investment choice for individuals and institutions looking to diversify their portfolios while earning fixed income. Unfortunately, not all corporate bonds offer equal protection or potential returns. Secured and unsecured corporate debt investments provide various levels of security and possible return, thus necessitating investors to understand these in detail before making investment decisions.

As part of your investment process in corporate bonds, you must know the difference between secured and unsecured bonds. Are you aware of their respective risks and benefits? Assessing corporate debt investments will enable you to make informed decisions and maximise returns.

Here, we will deeply dive into the key differences between secured and unsecured corporate bonds and factors investors must consider when assessing such investments. By developing an in-depth knowledge of both types of bonds, you can make better decisions and increase your chances of financial success and wealth creation.

Secured Corporate Bonds

Secured corporate bonds provide investors with additional protection through collateral backing. When companies issue these bonds, they pledge specific assets such as real estate, inventory or receivables as security against default or non-payment. In case of default, bondholders are entitled to sell these secured assets (through a legally mandated process) to recover principal and interest payments.

Below are the characteristics of secured bonds:

- Collateral Backing: These bonds are guaranteed with specific assets or collateral. In case of any default, the bondholders have the right to recourse.

- Higher Priority: Secured bondholders enjoy priority in terms of repayment compared to unsecured ones in a liquidation scenario.

- Lower Risk: Secured corporate bonds are considered less risky than unsecured bonds due to the availability of collateral. This safety net (in the form of collateral backing) can reduce losses and ensure that the bondholders' interests are preserved in case of default.

- Lower Yield: Due to the higher security offered by secured bonds than unsecured bonds, their yields tend to be lower than unsecured bonds. Investors are willing to compensate for the lower risk with lesser returns.

Unsecured Corporate Bonds

Unsecured corporate bonds (or debentures) are issued without collateral being pledged. It relies solely on an issuer's creditworthiness and ability to meet its debt obligations in case of default. This means bondholders face a higher risk in recovering their investments.

Below are the characteristics of unsecured bonds:

- No Collateral: Unsecured corporate bonds do not rely on specific assets as collateral backing them. Instead, they rely solely on income generated from the respective business operations of the issuers for meeting the interest and principal repayment.

- Higher Risk: Unsecured bonds pose higher risks than secured ones due to the lack of collateral protection. The chances of recovery could be limited or non-existent in the case of default.

- Higher Yield: Unsecured bonds often offer higher yields in exchange for taking on additional risk. These investors demand compensation through higher returns as part of investing in the riskier alternative of the two.

- Creditworthiness: The issuing company's financial health and creditworthiness are relevant in determining yield and demand for unsecured bonds.

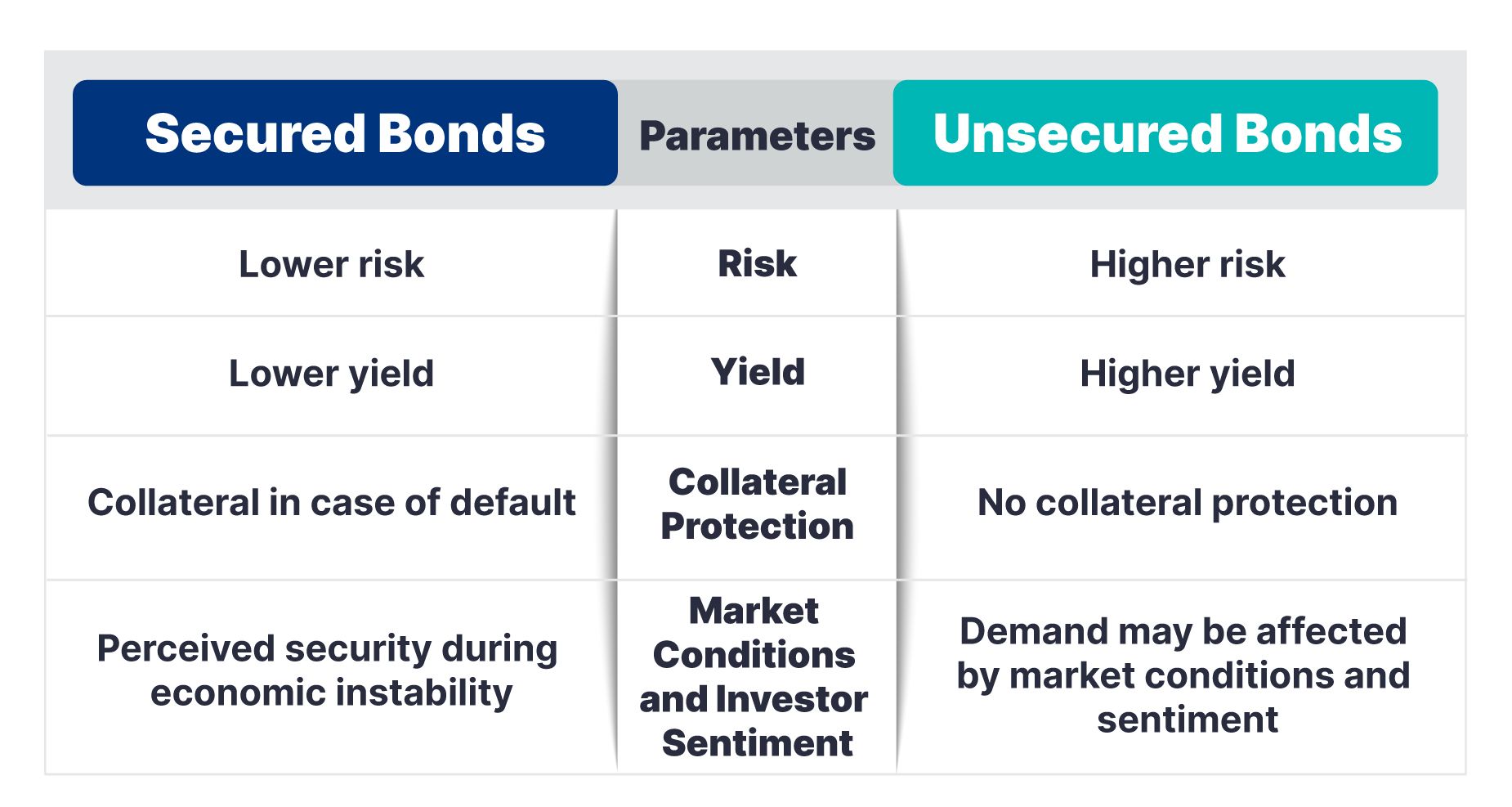

Key Differences Between Secured And Unsecured Bonds

Looking To Invest In High-Quality Corporate Bonds?

Whether you prefer secured bonds for stability or unsecured bonds for higher returns, corporate bonds offer an excellent opportunity to diversify your portfolio and earn predictable income.

1. Choose from AAA & AA-rated bonds

2. Enjoy fixed interest payouts & capital preservation

3. Invest in bonds carefully vetted for creditworthiness

Key Considerations When Investing In Unsecured Bonds

- Assessing Issuer Creditworthiness: As unsecured bonds do not offer collateral backing, investors must carefully examine their financial health, credit ratings, and track record to gauge whether the interest and principal payments can be paid promptly by the Issuer.

- Industry And Market Conditions: Traders should carefully examine overall economic trends and industry dynamics when investing in unsecured bonds.

- Investor Risk Tolerance: Investors must analyse their risk appetite and take calculated risks while investing in unsecured corporate bonds. Knowing the risk appetite helps investors in balancing the overall portfolio.

Final Thoughts

Comparing secured and unsecured corporate bonds requires careful analysis. Secured bonds provide some protection through pledged assets, while uncollateralised debt investments carry higher risks but could trade at potentially higher yields.

Explore Grip Invest to learn about favourable risk-reward investment opportunities in secured and rated corporate bonds. Grip Invest allows you to explore carefully curated alternative investment opportunities offering diversification and predictable returns.

Want to stay at the top of your finances?

Join the community of 2.5 lakh+ investors and learn more about Grip Invest, the latest financial knick-knacks and shenanigans that take place in the world of investing.

Happy Investing!

Disclaimer - Investments in debt securities are subject to risks. Read all the offer-related documents carefully. The investor is requested to take into consideration all the risk factors before the commencement of trading. This communication is prepared by Grip Broking Private Limited (bearing SEBI Registration No. INZ000312836 and NSE ID 90319) and/or its affiliate/ group company(ies) (together referred to as “Grip”) and the contents of this disclaimer are applicable to this document and any and all written or oral communication(s) made by Grip or its directors, employees, associates, representatives and agents. This communication does not constitute advice relating to investing or otherwise dealing in securities and is not an offer or solicitation for the purchase or sale of any securities. Grip does not guarantee or assure any return on investments and accepts no liability for the consequences of any actions taken based on the information provided. For more details, please visit https://www.gripinvest.in/.

Registered Address - 106, II F, New Asiatic Building, H Block, Connaught Place, New Delhi 110001.